Phiromya Intawongpan

Overview

I am analyzing Hercules Capital (NYSE:HTGC), a financial company that provides loans to private companies in the technology and life sciences industries. This company is appealing to investors due to its high dividend yield, making it suitable for portfolios with liquidity needs. However, we should not just consider liquidity but also assess all sources of value and determine if it is overvalued. Otherwise, we might end up with a poor investment despite the high dividends.

Financial Performance

Hercules Capital has displayed favorable operating performance, substantial origination, and funding activity, contributing to a solid balance sheet with ample liquidity. Its portfolio’s performance has been positive, and the company has continued to distribute dividends to shareholders, including a special distribution supported by a high net investment income.

In Q1, Hercules Capital achieved good performance with record gross debt and equity commitments and gross funding. The company provided $605.2 million in gross funding, the highest amount to date. Total investment income reached $121.6 million, reflecting a substantial year-over-year increase of nearly 16%. Net investment income totaled $79.2 million, with a growth rate of 21%, equivalent to $0.5 per share, covering 125% of the base distribution of $0.4 per share.

Hercules Capital has maintained a conservative balance sheet management strategy, with a GAAP Leverage of 93.6%. This prudent approach positions the company to seize future opportunities. The company’s credit quality has also shown improvement, with the highest credit scoring (Grade 1 and 2) increasing from 62.6% to 68%, and the poorer credit score (Grade 3) decreasing from 34.0% to 29.2%. This is reflected in the small ratio of loans on non-accrual as a percentage of the company’s investment portfolio, which stands at 1.2% and 0.1% as cost-based and fair value-based, respectively.

At the close of Q1, Hercules Capital had a strong balance sheet and a liquidity position of $498.1 million. It has maintained a base dividend distribution of $0.4 per share, representing an annualized base dividend yield of 8.7%. Its good cash position has allowed it to give a supplemental distribution of $0.08 per share. I appreciate the company’s commitment to shareholders. Net asset value per share has increased by 1.7% from the previous quarter, reaching $11.63 per share, signaling financial strength.

Competitive Advantages

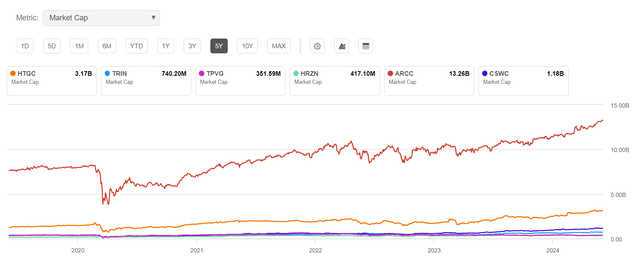

Hercules Capital is a business development company (BDC). It is one of the biggest players in the industry, as shown in Figure 1. Its capitalization is $3.17 billion, the second-biggest company, only behind Ares Capital (ARCC), with $13.26 billion.

Figure 1: Seeking Alpha

Hercules Capital manages a lending platform with assets valued at $3.6 billion. This platform allows them to lead in the tech and life science industry, providing fast financial solutions and being a credible player. Its portfolio comprises 127 companies. This focused strategy has allowed the company to have deep expertise in complex industries that are a barrier to entry for new players attempting to enter the market. There are investments in warrants in 104 companies and equity positions in 76 companies, totaling $183 million. The platform also has net debt commitments worth $18 billion in 650 companies.

To evaluate its competitive position, I compare it with its peers. Hercules Capital has some advantages in yield return and credit quality, but not a clear advantage over leverage. Its competitive position is solid, but it is not a clear winner.

The yield is higher than that of Ares Capital (ARCC), a bigger competitor with better negotiation power. Hercules Capital’s yield is 14.3%, and Ares Capital’s is 12.4%. Horizon Technology Finance Corporation (HRZN) gets one of the biggest yields, at 15.6%.

Areas Capital has a leverage of 95%, which is in line with Hercules Capital. Capital Southwest (CSWC) is 82% less risky; however, you can find companies like Horizon Technology with a leverage of 137%, which is much worse.

The Accruals ratio at Hercules Capital is better than Ares Capital’s, with a ratio of 1.7% cost-based, and much better than Capital Southwest’s, at 2.3%.

The company has solid financial performance and dividend distributions because of its strategic focus on the tech and life sciences sector, its large and specialized lending platform, and its many years of expertise in this industry. The company’s ROAE was 18.8% in 1Q2024.

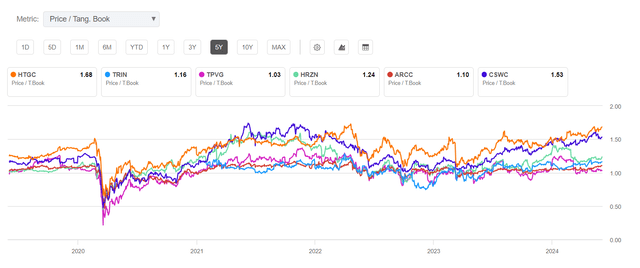

I conclude that Hercules Capital’s strategy has some advantages that justify the premium the market assigns over its competitors, as shown in Figure 2.

Figure 2: Seeking Alpha

Risks

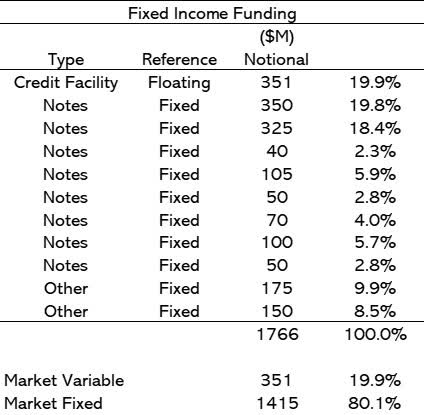

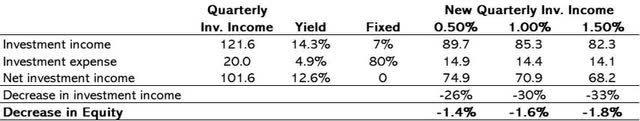

The main risk in Hercules Capital’s business is market risk, which refers to how changes in interest rates affect investment income. The investment portfolio is based on fixed-income assets with floating-rate investments (97%) and a smaller proportion of fixed-income investments with fixed rates. On the other hand, funding is 80% fixed and 20% with variable rates. This structure makes the investment risky in a scenario where interest rates could decrease. I expect that when the Fed lowers rates, Hercules Capital will decrease net investment income because income is mostly floating and would decrease. Income expense, which is what the company pays for the debts it owes, is mostly fixed so that it would decrease less.

Figure 3: Author

In a Reuters poll, most economists surveyed estimate that the rate will be cut in September, with half saying there will be two decreases. There is a lot of discussion around the market about when rates will be cut. My conclusion is that it is probable to get the rates cut this year, and investment income will decrease when it occurs.

Another risk is credit risk, which refers to companies late in paying back loans or not paying the full amount. I believe the company effectively manages credit risk. Most loans are senior secured 1st position debt, at least 83%. As I have mentioned, non-accrual as a percentage of the company’s total investment portfolio is very low. However, the company operates in a highly concentrated industry and geography. Specifically, 89% of its operations are based in the US, and 65% of the company’s funding is allocated to the Life Science industry. Although this concentration poses inherent risks, it is part of the company’s strategy. Therefore, the only way to mitigate this risk is through diversification.

The final risk I identify for Hercules Capital is competition. This type of risk is quite limited due to Hercules Capital’s strong market position in the industry. As I mentioned earlier when discussing competitive advantage, the company holds a solid position on its lending platform.

Valuation

When evaluating this type of financial company, I estimate the price-to-net asset value, equivalent to the price-to-book value. This helps determine if it’s expensive or cheap.

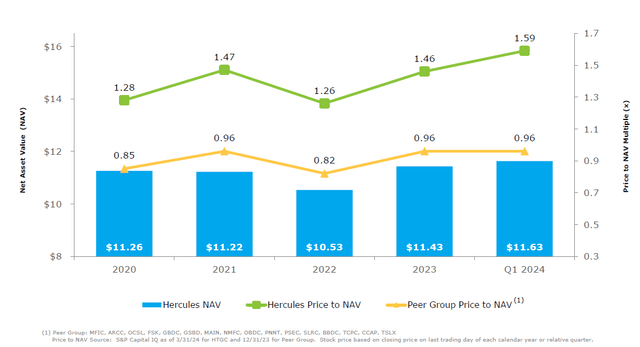

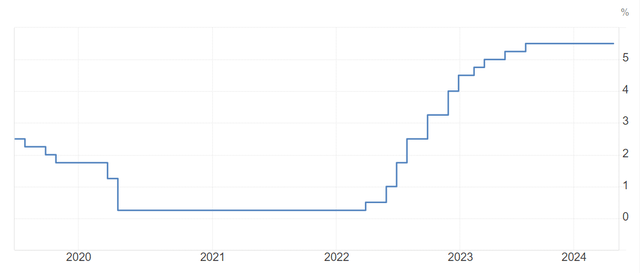

At the end of 1Q2014, Hercules Capital had a price-to-NAV ratio of 1.59. As you can see in Figure 4, this is the highest in the last four years, and I believe it is not sustainable. One of the main reasons for this multiple is the interest rate evolution. As shown in Figure 5, interest rates are higher in 2023 and 2024. Hercules Capital’s business model is favored when interest rates are higher because its short-term loans benefit from higher interest rates and yield raises.

Figure 4: Hercules Capital Investor Presentation

Figure 5: red.stlouisfed.org/series/DFF

.

As shown in Figure 6, I have simulated the effect of an increase in interest rates on net investment income. I have tested increases of 0.5 percentage points, 1.0 percentage points, and 1.5 percentage points. The current investment income stands at 121.6, with a yield of 14.3%. The investment expense refers to the interest paid on the loans that fund Hercules. Net income is $101.6 million with a net Yield of 12.6%. If the interest rates decrease by 0.5 percentage points, the net income will decrease by 26%. If the interest rates decrease by 1.5 percentage points, the net income will decrease by 33%. This effect on net income is directly linked to dividend distribution, and it is one of the reasons why investors have confidence in the company. Therefore, I anticipate that the stock price will significantly decrease if the dividend distribution is at risk.

Figure 6: Author

Conclusion

Hercules Capital premium has a maximum price in an environment with high-interest rates and a high probability of lowering those rates. As long as rates decrease, the stock price will go down. So, I recommend waiting until rates are lowered and, in a low-interest environment, investing in this company with good fundamentals. My recommendation is a hold.

from Finance – My Blog https://ift.tt/dbSsTYU

via IFTTT

No comments:

Post a Comment