PM Photographs

Late final 12 months, I revealed an article titled, “Why I Made Huge Modifications To My Dividend Progress Portfolio” which highlighted a sequence of gross sales that I made to assist pay for a brand new house that we’re constructing.

On the time, I talked about that I wasn’t solely trying to make the deposit on the construct, however that I used to be additionally trying to simplify my monetary life a bit by lowering my portfolio holdings.

When fascinated by streamlining holdings, I needed to start taking steps to cut back/eradicate publicity to sure industries that I not felt strongly about.

In brief, I needed to get extra concentrated into my high concepts (usually, excessive progress compounders) and cut back publicity to low progress, deep worth/excessive yield-centric concepts.

For years, I’ve overwhelmed the market persistently with my authentic DGI-centric strategy; nonetheless, I consider that his extra concentrated, compounder-oriented technique will yield even higher long-term outcomes whereas additionally saving me time/vitality in my day-to-day life.

The method that I started late final 12 months has continued all through 2024 to date and subsequently, I needed to supply one other replace on my portfolio, highlighting lots of the trades that I’ve made to date in 2024 as I slowly, however absolutely, reshape my portfolio.

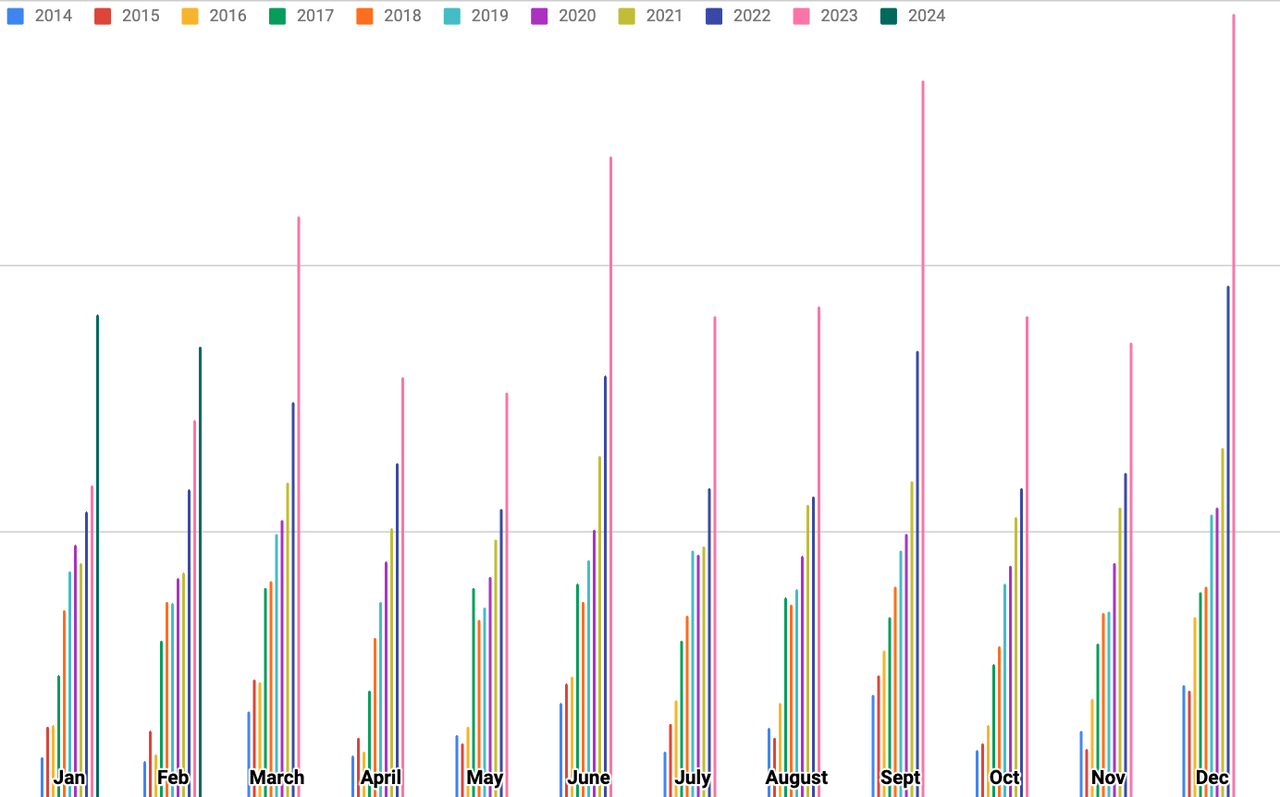

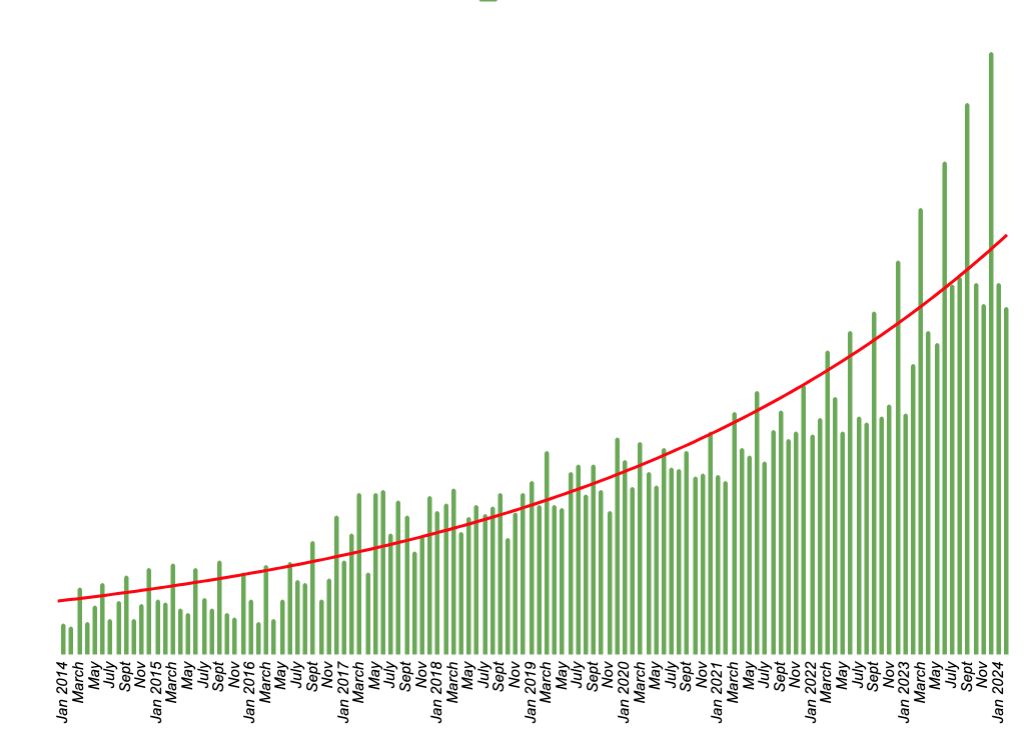

In doing so, I’ll present a number of charts displaying my dividend progress traits/trajectory and a desk that features my present holdings, price foundation, acquire/loss %, and portfolio weightings to provide readers a way of how the dividend progress investing technique can work over time.

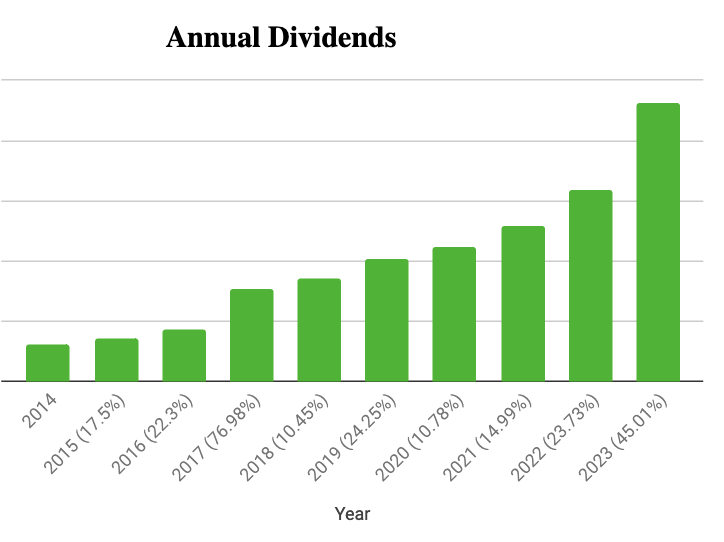

Dividend Progress Outcomes

Before everything, let’s speak about my dividend progress outcomes (that are the inspiration of my monetary freedom plans). If you wish to examine current trades, skip all the way down to the following sub-header.

Nick’s Knowledge

2023 was a tremendous 12 months for me when it comes to passive revenue, largely due to the truth that I used to be in a position to generate excessive yields on my money place (my natural revenue progress was nowhere close to 45%; nonetheless, energetic administration and asset allocation decision-making offered large good points).

I’m grateful for top yields on cash market funds, however they will end in very powerful comps for me to clear in 2024.

So will the trades that I made late final 12 months to start paying for our new house, alongside a number of of the trades that I’ll talk about beneath.

However, it takes time for these headwinds to trickle into my dividend outcomes. To this point, the primary two months of the 12 months have been nice.

In January, I posted 54.5% y/y revenue progress. And in February I posted 19.44% y/y revenue progress. On the finish of February, I used to be up by 35.28% in comparison with the primary two months of 2023.

However, wanting ahead, I anticipate to see adverse outcomes start to indicate up due to asset allocation/trades that I’ve made over the past 6 months or so and subsequently, I wouldn’t be stunned to see my 2024 passive revenue are available in beneath my 2023 passive revenue (this may be the primary time that I’ve ever generated adverse y/y passive revenue outcomes).

Nick’s Knowledge

Even so, we’re enthusiastic about our new home. And searching over the long-term, I feel a little bit of a re-set with regard to a few of my low conviction, excessive yield positions (potential worth traps) was warranted.

I don’t handle my portfolio with the following month or quarter’s ends in thoughts. As a substitute, I’m fascinated by my monetary place 5-10 years down the highway and as I proceed to reshape my portfolio, I consider that the general high quality of my holdings continues to enhance.

Whereas my passive revenue could also be decrease this 12 months, I consider that I’m setting the desk up properly for continued double digit annual revenue progress in 2025 and past.

Nick’s Knowledge

Over the longer-term, I consider that this crimson trend-line will proceed alongside its optimistic exponential slope.

Reshaping My Portfolio

Now I’ll spotlight all the gross sales that I’ve made for the reason that begin of 2024 as I take steps to get extra concentrated into my highest conviction concepts.

On 1/2/2024 I bought Cummins (CMI) at $240.02, locking in 10.3% income.

This one was unplanned, however merely. I didn’t have any plans to promote my CMI place on the finish of final 12 months. I believed shares have been undervalued, the yield was strong, and I favored the overall return potential in a imply reversion scenario if/when the industrials caught a bid. However, the unlawful defeat system concern and the $1b+ fines have been an unexpected concern for me. Since I used to be sitting on income when the information broke, I bought my shares on account of misplaced belief with administration (on the finish of the day, I really feel as if I can’t belief the administration groups of the businesses that I personal, then I shouldn’t personal them). When fascinated by lowering my place rely, that was a simple name.

On 1/2/2024 I bought Digital Realty (DLR at $134.52, locking in 169.7% income.

Digital Realty was a inventory I used to be going to promote in 2023 when elevating money to make the deposit cost on my new house construct, however I didn’t need to take the tax penalty since I already had large capital good points locked in. Properly, as quickly because the 12 months reset, I went forward and locked in triple digit income right here due to poor dividend progress metrics and a excessive valuation. At ~24x AFFO, I believed DLR was expensive (given its mid-single digit progress prospects). Moreover, DLR hasn’t raised its dividend since March of 2022 and subsequently, the inventory was breaking a basic rule in my portfolio. Any firm that goes 8+ quarters with the identical dividend cost is a first-rate promote candidate for me. As soon as once more, locking in income on DLR was a simple resolution right here when fascinated by simplifying issues a bit.

I used the DLR proceeds to bolster my bear market money place. This money is now sitting in SPAXX, producing a better yield than DLR, whereas the identical (0%) revenue progress expectations. With markets hitting new all-time highs I needed to begin making ready for the following sell-off. I don’t know when it’s going to come, however when it does, I now have my full money arsenal able to go (similar to I did through the 2020 and 2022 sell-offs).

On 1/11/2024 I bought Service (CARR) at $56.95, locking in 74.3% income.

I feel Service is a effective firm. However, I used to be dissatisfied in its most up-to-date dividend increase (simply 2.7% on a y/y foundation) and being that CARR was a really small place for me (lower than 0.20%) I used to be joyful to take income within the new tax 12 months. Due to the poor 2023 dividend increase, I needed to plans so as to add to CARR anytime quickly. And subsequently, because of the small place dimension, promoting the shares made sense in order that I not have to trace the corporate. Principally, this one was nearly effectivity and saving myself time/vitality/stress within the due diligence/portfolio administration course of.

I purchased extra shares of Visa (V) with the Service proceeds.

On 1/22/2024 I bought Lowe’s (LOW) at $219.30, locking in 62.3% income.

Late final 12 months I wrote this text explaining why I bought my Residence Depot (HD) shares. In brief, when fascinated by lowering my place rely and getting extra concentrated into my high concepts, I’m promoting out of low-conviction areas of the market. Considered one of these industries is bodily retail. I’ve been shopping for Amazon (AMZN) aggressively all through 2024 to exchange this publicity. I choose that strategy to play the buyer because it comes with the secular progress tailwinds related to cloud, digital adverts, and AI progress.

With the LOW proceeds I added to present positions in Amazon (AMZN), Rexford Industrial (REXR), Air Merchandise and Chemical substances (APD), and I began a brand new place in Elevance Well being (ELV).

On 2/1/2024 I bought Pfizer (PFE) at $26.96, locking in 29.3% losses.

One other space of the market that I’m trying to cut back publicity to shifting ahead within the bio-pharma business. To me, this business is simply too unpredictable. It has all the time required M&A execution to work (blue chips on this area have to make use of the gross sales from their blockbuster medication to purchase future income progress earlier than patent cliffs come up). And if you throw in regulatory threats and the possibly important affect of AI on the business (from a analysis/growth standpoint) I feel issues are going to grow to be much more unpredictable. On high of that uncertainty, I fear in regards to the aggressive moats of the businesses that I personal due to the inevitability of patent cliffs. Truthfully, I’m undecided that it’s potential to assign a large moat ranking to any of those corporations, regardless of how sturdy their drug portfolios and stability sheets are, due to the character of the business relating to patent cliffs. The very fact is, I’m not a scientist. I don’t have superior levels in chemistry or biology. And subsequently, it’s troublesome to maintain up with the early stage pipeline belongings that these corporations personal/purchase through M&A. I monitor the portfolios of plenty of so-called “tremendous traders” that concentrate on broad moat, monopolistic compounders and one of many frequent themes that I’ve observed is the shortage of bio-pharma shares. When fascinated by simplifying my portfolio and life, I’ve determined to comply with an analogous path. I nonetheless personal a handful of bio-pharma shares. I’m not in a rush to make this transition. However slowly and absolutely, I anticipate to exit the business and I made a decision that promoting PFE – which was my lowest high quality/conviction choose within the area – was a very good place to begin.

On 2/1/2024 I bought Federal Realty Funding Belief (FRT) at $101.81, locking in 11.4% losses.

When fascinated by shifting away from bodily retail, FRT was one other firm on the high of my sell-list. The corporate trades with a premium valuation to friends and whereas there’s an argument to be made that its top-tier portfolio warrants it, I used to be joyful to take FRT shares off of the desk and reallocate the funds in the direction of a better yielding Realty Earnings (which additionally presents publicity to a extra diversified property portfolio). FRT was a long-term maintain for me, so although the shares have been bought at a loss, with dividends included, whole returns have been solidly within the black. Even so, FRT was an underperformer for me and shifting ahead, when fascinated by getting out of gradual rising, low conviction picks with comparatively poor whole return outlooks, FRT was a simple place to chop.

On 2/1/2024 I bought Royal Financial institution of Canada (RY) at $97.79, locking in 2.4% losses.

As soon as once more, this sale was about lowering redundancy since I’m additionally lengthy shares of The Toronto-Dominion Financial institution (TD). When evaluating the 2, TD was my high choose from the Canadian banking area, so chopping ties with RY was a simple strategy to simplify my life whereas sticking with my favourite shares. As soon as once more, the proceeds from this sale went into Realty Earnings to assist bolster my yield whereas additionally rising my publicity to one among my high high-yield picks.

I ought to notice that alongside of O, I additionally added to my RTX (RTX) and Northrop Grumman (NOC) positions with the proceeds of those excessive yielders + the Cummins sale from January.

As soon as the misplaced revenue was coated by O’s greater yield, I used the remainder of the money to bolster my progress and preserve industrial publicity with RTX/NOC.

On 2/2/2024 I bought Altria (MO) at $41.43, locking in -2.2% losses.

Like FRT, MO was an organization I had owned for years, so with dividends included, my whole returns right here have been strong. MO has underperformed the market over the past 5 years or so in a serious manner although (even with that huge dividend yield included) and shifting ahead, I wouldn’t be stunned to see that development proceed (even with the inventory’s very low valuation in thoughts). Merely out, I’ve misplaced religion in the concept that we’ll see a number of growth through imply reversion for the tobacco names anytime quickly – if ever. When fascinated by pivoting out of low progress, deep worth names, each MO and British American Tobacco have been straightforward cuts. It was troublesome promoting these names from an revenue oriented perspective, although. I hate making trades that injury my passive revenue stream and by promoting Altria, I definitely did that. I wasn’t eager about chasing yield with the proceeds as a result of my focus is on high quality, above yield/worth nowadays. With that in thoughts, my year-over-year revenue progress could be very possible going to be adverse through the months that MO pays a dividend, however that’s okay. I ended up going fairly closely into Meta Platforms with the proceeds from the MO/BTI sale and over the long-term, I feel the sturdy, double digit basic and dividend progress prospects from these shares will result’s a lot greater returns that I might have acquired if I had held onto my tobacco shares.

On 2/2/2024 I bought British American Tobacco (BTI) at $30.13, locking in -19.5% losses.

The identical logic applies to this commerce because the one above. When fascinated by promoting out of low conviction/low progress concepts and getting extra concentrated all through my portfolio, promoting out of BTI made sense to me as I moved out of the tobacco business. I do know that is an space of the market which have generated large wealth for traders for many years. Nonetheless, I feel the world is altering. I don’t essentially consider that lowered danger merchandise will save these corporations (a minimum of, when it comes to returning to sturdy high/bottom-line progress). Sure, they proceed to own pricing energy due to the addictive nature of the merchandise, however cigarette volumes proceed to glide decrease and I don’t suppose that’s a sustainable development when it comes to dividend security.

I’ve been trimming away at my tobacco stakes for a number of years now and in February I made a decision to tug the ultimate plug as I used to be trying to increase money to purchase into META after its dividend announcement.

On 2/14/2024 I bought Cisco (CSCO) at $47.80, locking in 100.8% income.

Through the pandemic, I gave corporations a go when it got here to poor dividend progress. I get it…these have been occasions of unprecedented uncertainty. However, now that we’re again to regular occasions, I’m again to regular expectations on the subject of dividend progress. When CSCO offered a ~2% dividend increase in 2023, I trimmed my place on the disappointing information. I advised subscribers that if it occurred once more in 2024, I’d promote the remainder of my shares. Properly, CSCO dissatisfied once more with its 2.6% increase and I minimize ties with the corporate. CSCO’s ~3.3% yield was secure in my view, however at that yield stage, I have to see 5-7% annual dividend progress. Cisco wasn’t residing as much as these expectations so I bought out and purchased a basket of CME Group (CME), Amazon (AMZN), Starbucks (SBUX), and PepsiCo (PEP).

I’ve mentioned my bullish outlooks for every of those corporations just lately:

On 2/22/2024 I bought Veralto (VLTO) at $86.07, locking in 2% income.

My current Veralto sale was pushed by an analogous mindset to my Service one. These have been each spin-off corporations and comparatively low conviction picks shifting ahead. They have been each small positions that I didn’t have plans so as to add to. And subsequently, I made a decision to save lots of myself time and vitality by eradicating them from my portfolio (and subsequently, eradicating the necessity to carry out common due diligence on the shares). My VTLO stake made up lower than 0.20% of my portfolio so the sale right here was not important.

I used the proceeds to bolster my AMZN place (one among my highest conviction picks in right this moment’s market).

On 2/22/2024 I bought Merck (MRK) at 129.33, locking in 75.5% income.

Merck is an excellent firm, however like I mentioned earlier than, the bio-pharma area is an space of the market that I’m trying to pivot out of. And this MRK commerce is an instance of the perfect playbook shifting ahead. Throughout their year-to-date rally, MRK shares ran up above my honest worth estimate for them, permitting me to lock in massive income on shares that have been not buying and selling with a gorgeous margin of security.

With the Merck proceeds I purchased shares of Blue Owl Capital Corp. (OBDC), AvalonBay Communities (AVB), Amazon, and Meta.

This was a little bit of a barbell commerce, with OBDC/AVB masking the revenue that I misplaced from the MRK commerce and META/AMZN offering publicity to sturdy, secular progress traits.

Proper now, I consider that different important bio-pharma positions in my portfolio corresponding to Amgen (AMGN) and Johnson & Johnson (JNJ) are undervalued. I’m already sitting on massive good points on AMGN/JNJ; nonetheless, I don’t need to promote out of blue chips once they’re undervalued. As I’ve mentioned many occasions earlier than, promoting low is an effective way to underperform. If these names have been to rally as much as the purpose that I not believed they have been low-cost, I might contemplate promoting as properly. However, within the meantime, I’ll proceed to carry onto them and gather their respectable dividend yields whereas I look forward to the market’s general sentiment surrounding the healthcare sector to enhance.

On 2/23/2024 I bought L3Harris Applied sciences (LHX) at $214.7, locking in 11.7% income.

Like this CSCO commerce, this one was on account of two consecutive years of disappointing dividend progress. Final 12 months, when LHX’s increase was just one.8% I put the inventory within the penalty field, which means that I might not add to it till the dividend progress obtained proper…and if it dissatisfied once more the next 12 months, shares can be bought (fantastic corporations all the time get that 1-year grace interval whereas I look forward to higher dividend progress charges). Properly, LHX dissatisfied once more this 12 months once they introduced a 1.8% increase in late February. LHX yields ~2.2% and at that stage, I’m in search of 6-8% annual will increase. They didn’t meet expectations and since I used to be sitting on income, it was a simple resolution to maneuver on.

I used the LHX proceeds to purchase shares of Reserving Holdings (BKNG), which is now one among my highest conviction dividend progress picks (as just lately mentioned on this report).

On 2/26/2024 I trimmed roughly 20% of my GOOGL place at $137.73, locking in 170.5% income.

After Alphabet’s most up-to-date journey up with its generative AI platform, I purchased into a number of the rising issues that they’re falling behind within the race. Moreover, I’ve been studying stories in regards to the threats that their search platform is dealing with (which is their money cow) – together with the chance that it might need to be disrupted by their very own LLM for them to compete long-term – which have been regarding Being that I used to be so closely chubby Alphabet, I made a decision to trim the place, taking important income on shares held in an IRA (so no adverse tax penalties). I bought roughly 20% of my stake, lowering my weighting from 4.3% to three.6% (on the time). GOOGL stays a top-10 holding for me as a result of I nonetheless consider that shares are attractively valued. Moreover, I really consider that if GOOGL adopts a extra disciplined plan with regard to capex and shareholder returns like META has just lately, their shares may pop 10-20% instantly. However, that’s an enormous “if” with regard to administration’s plans for the corporate. The market rewarded META in a serious manner for its 12 months of Effectivity and I think that GOOGL may obtain related remedy. However, I feel there’s a very good argument to be made that META has greater high quality administration than GOOGL proper now, so I’m undecided if they’ll pull that type of transformation within the short-term (META lowered its head rely by over 20% in a 12 months). Regardless, I didn’t need to be grasping sitting on triple digit income on an chubby place and after the inventory’s important ttm and year-to-date rally, I took some danger off of the desk.

I used the GOOGL proceeds to purchase extra Reserving Holdings and Meta Platforms, sustaining progress prospects whereas additionally bolstering my passive revenue stream.

On 2/29/2024 I bought Blackstone (BX) at $127.29, locking in 30.5% income.

On 2/29/2024 I bought Brookfield Infrastructure Corp. (BIPC) a $33.90, locking in 9.1% income.

On 2/29/2024 I bought Brookfield Renewable Corp. (BEPC) at $23.84, locking in 28.8% losses.

And, on 2/29/2024 I bought Brookfield Asset Administration (BAM) at $40.36, locking in 70.5% income.

I’ll speak about these 4 last gross sales collectively since they have been all impressed by an analogous mindset and made as a bunch, with income in thoughts.

I made a decision to maneuver away from the Brookfield funds due to their complexity. These corporations are comparatively time consuming and troublesome to investigate. My conviction behind my honest worth estimates on these corporations have been comparatively low due to their subtle financials and the truth that they don’t all the time commerce on conventional earnings metrics. BAM, BEPC, and BIPC all continued to satisfy my revenue oriented requirements (with yield + dividend progress in thoughts). However, I made a decision to half methods with all 3 shares in my pursuit for a extra concentrated/easy portfolio.

Due to the big losses that I used to be taking a look at on the BEPC shares, I made a decision to incorporate my Blackstone place on this commerce basket to make sure that general, I used to be locking in good points. BX has all the time been a comparatively low precedence maintain for me due to its variable dividend (I choose extra predictable passive revenue payers). As soon as once more, I feel BX is a effective firm. However, it has been one among my extra risky corporations and I used to be joyful to lock in good points right here after a robust begin to 2024.

General, my income on this basket have been 3.45%.

Once more, I took a barbell strategy with the proceeds of this commerce, including to my Meta Platforms, and Salesforce positions when in search of progress/dividend progress after which my Most important Road Capital (MAIN) and Ares Capital Corp. (ARCC) to assist exchange misplaced revenue.

Lastly, On 3/12/2024 I bought Illinois Instrument Works (ITW) at $261.20, locking in 98.8% income.

ITW is an excellent firm, no doubt. It’s a dividend aristocrat that continues to submit strong, mid-to-high single digit annual dividend progress. Nonetheless, I feel that shares are probably grossly overvalued proper now (ITW is buying and selling for ~26x ahead with 4-6% earnings progress prospects over the following a number of years). This has lowered my forward-looking whole return estimate to mainly 0% between now and 2026 (I anticipate to see ITW’s earnings a number of contract because it reverts to its historic imply). With these poor return prospects in thoughts, when trying to increase capital to purchase extra Reserving Holdings final week, ITW stood out as a number one sale candidate. Moreover, the truth that I held shares in a retirement account, which means no adverse tax implications related to the large good points, was a plus.

I’d be joyful to purchase again into ITW sooner or later; nonetheless, I’d be trying to pay 18-20x earnings.

Within the meantime, I used the proceeds of this commerce to purchase extra shares Reserving Holdings at $3,505.37 and Automated Knowledge Processing (ADP) at $245.21 final week.

Nicholas Ward’s Dividend Progress Portfolio

|

Ticker |

Identify |

Share Value |

Value Foundation/Share |

General Acquire/Loss % |

Portfolio Weighting |

|

(AAPL) |

Apple Inc. |

$172.62 |

$22.79 |

657.44% |

7.50% |

|

(NVDA) |

NVIDIA Corp |

$878.37 |

$61.61 |

1325.69% |

5.44% |

|

(AVGO) |

Broadcom Inc. |

$1,235.50 |

$234.30 |

427.32% |

4.84% |

|

(MSFT) |

Microsoft Corp |

$416.42 |

$80.69 |

416.07% |

4.82% |

|

(AMZN) |

Amazon.com, Inc. |

$174.42 |

$113.22 |

54.05% |

3.51% |

|

(GOOGL) |

Alphabet Inc. Class A |

$141.18 |

$45.01 |

213.66% |

3.48% |

|

(V) |

Visa Inc. |

$283.04 |

$124.24 |

127.82% |

3.04% |

|

(QCOM) |

Qualcomm Inc. |

$167.20 |

$76.44 |

118.73% |

2.09% |

|

(O) |

Realty Earnings Corp |

$52.19 |

$59.43 |

-12.18% |

2.07% |

|

(BLK) |

BlackRock, Inc. |

$802.52 |

$462.83 |

73.39% |

2.05% |

|

(META) |

Meta Platforms, Inc. |

$484.10 |

$479.44 |

0.97% |

1.98% |

|

(RTX) |

RTX Corp |

$92.93 |

$84.65 |

9.78% |

1.69% |

|

(APD) |

Air Merchandise and Chemical substances, Inc. |

$244.63 |

$260.12 |

-5.95% |

1.58% |

|

(BKNG) |

Reserving Holdings Inc. |

$3,413.98 |

$3,503.75 |

-2.56% |

1.55% |

|

(CNI) |

Canadian Nationwide Railway Co |

$128.62 |

$112.23 |

14.60% |

1.44% |

|

(SBUX) |

Starbucks Corp |

$90.12 |

$51.21 |

75.98% |

1.43% |

|

(CRM) |

Salesforce, Inc. |

$294.33 |

$294.32 |

0.00% |

1.39% |

|

(SPGI) |

S&P World Inc. |

$422.81 |

$358.53 |

17.93% |

1.31% |

|

(USFR) |

WisdomTree Floating Fee Treasury Fund |

$50.41 |

$50.40 |

0.02% |

1.28% |

|

(JNJ) |

Johnson & Johnson |

$158.18 |

$114.02 |

38.73% |

1.27% |

|

(PEP) |

PepsiCo, Inc. |

$164.66 |

$115.51 |

42.55% |

1.26% |

|

(PH) |

Parker-Hannifin Corp |

$535.42 |

$255.96 |

109.18% |

1.17% |

|

(MAIN) |

Most important Road Capital Corp |

$46.20 |

$41.19 |

12.16% |

1.12% |

|

(ABBV) |

AbbVie Inc. |

$177.88 |

$79.08 |

124.94% |

1.09% |

|

(MA) |

Mastercard Inc. |

$475.83 |

$119.79 |

297.22% |

1.08% |

|

(HON) |

Honeywell Worldwide Inc. |

$197.69 |

$142.19 |

39.03% |

1.06% |

|

(TMO) |

Thermo Fisher Scientific Inc. |

$584.15 |

$529.96 |

10.23% |

1.01% |

|

(OBDC) |

Blue Owl Capital Corp |

$15.22 |

$13.95 |

9.10% |

1.01% |

|

(ACN) |

Accenture plc |

$374.60 |

$270.99 |

38.23% |

0.99% |

|

(BR) |

Broadridge Monetary Options, Inc. |

$200.20 |

$148.90 |

34.45% |

0.98% |

|

(NKE) |

Nike, Inc. |

$99.64 |

$62.68 |

58.97% |

0.98% |

|

(LMT) |

Lockheed Martin Corp |

$435.82 |

$354.14 |

23.06% |

0.95% |

|

(UNH) |

UnitedHealth Group Inc |

$490.82 |

$484.60 |

1.28% |

0.94% |

|

(KO) |

Coca-Cola Co |

$59.88 |

$42.38 |

41.29% |

0.88% |

|

(TXN) |

Texas Devices Inc |

$172.52 |

$110.11 |

56.68% |

0.83% |

|

(DE) |

Deere & Co |

$383.39 |

$347.85 |

10.22% |

0.80% |

|

(CME) |

CME Group Inc. |

$217.50 |

$196.49 |

10.69% |

0.79% |

|

(REXR) |

Rexford Industrial Realty, Inc. |

$51.41 |

$52.86 |

-2.74% |

0.79% |

|

(AVB) |

AvalonBay Communities, Inc. |

$183.82 |

$168.21 |

9.28% |

0.79% |

|

(ECL) |

Ecolab Inc. |

$226.70 |

$150.04 |

51.09% |

0.78% |

|

(ENB) |

Enbridge Inc. |

$35.52 |

$39.33 |

-9.69% |

0.78% |

|

(AMGN) |

Amgen Inc. |

$268.87 |

$136.07 |

97.60% |

0.76% |

|

(DHR) |

Danaher Corp |

$249.40 |

$211.57 |

17.88% |

0.75% |

|

(ARCC) |

Ares Capital Company |

$20.19 |

$19.08 |

5.82% |

0.71% |

|

(CP) |

Canadian Pacific Kansas Metropolis Ltd |

$89.68 |

$71.64 |

25.18% |

0.70% |

|

(ASML) |

ASML Holding N.V. |

$940.21 |

$649.43 |

44.77% |

0.69% |

|

(LIN) |

Linde plc |

$468.23 |

$355.48 |

31.72% |

0.64% |

|

(BIL) |

SPDR Bloomberg 1-3 Month T-Invoice ETF |

$91.63 |

$91.63 |

– |

0.63% |

|

(NOC) |

Northrop Grumman Corp |

$461.75 |

$385.78 |

19.69% |

0.63% |

|

(HSY) |

Hershey Co |

$193.54 |

$217.10 |

-10.85% |

0.62% |

|

(ICE) |

Intercontinental Trade, Inc. |

$134.64 |

$97.23 |

38.48% |

0.61% |

|

(ELV) |

Elevance Well being, Inc. |

$513.08 |

$474.58 |

8.11% |

0.56% |

|

(NNN) |

NNN REIT, Inc. |

$41.46 |

$38.38 |

8.03% |

0.54% |

|

(TD) |

Toronto-Dominion Financial institution |

$60.06 |

$65.06 |

-7.69% |

0.51% |

|

(ADP) |

Automated Knowledge Processing, Inc. |

$242.09 |

$238.79 |

1.38% |

0.51% |

|

(WM) |

Waste Administration, Inc. |

$210.53 |

$159.54 |

31.96% |

0.50% |

|

(MCD) |

McDonald’s Corp |

$279.14 |

$258.34 |

8.05% |

0.46% |

|

(BAH) |

Booz Allen Hamilton Holding Company |

$144.79 |

$75.49 |

91.80% |

0.44% |

|

(SHW) |

Sherwin-Williams Co |

$334.66 |

$219.30 |

52.60% |

0.43% |

|

(ESS) |

Essex Property Belief, Inc. |

$239.07 |

$214.97 |

11.21% |

0.41% |

|

(ZTS) |

Zoetis Inc. |

$172.57 |

176.61 |

-2.29% |

0.39% |

|

(PLD) |

Prologis, Inc. |

$129.02 |

$118.30 |

9.06% |

0.38% |

|

(MCO) |

Moody’s Corp |

$384.16 |

$326.70 |

17.59% |

0.35% |

|

(MSCI) |

MSCI Inc. |

$544.74 |

$469.41 |

16.05% |

0.35% |

|

(RSG) |

Republic Providers, Inc. |

$186.31 |

$123.71 |

50.60% |

0.32% |

|

(A) |

Agilent Applied sciences, Inc. |

$147.48 |

$116.28 |

26.83% |

0.28% |

|

(CSL) |

Carlisle Corporations Inc. |

$371.48 |

$228.31 |

62.71% |

0.27% |

|

(CPT) |

Camden Property Belief |

$98.49 |

$114.08 |

-13.67% |

0.27% |

|

(ARE) |

Alexandria Actual Property Equities, Inc. |

$123.75 |

$130.96 |

-5.51% |

0.26% |

|

(PLTR) |

Palantir Applied sciences Inc. |

$23.49 |

$10.79 |

117.70% |

0.12% |

|

Money |

12.07% |

Conclusion

Since late final 12 months, I’ve trimmed my place rely down from roughly 90 corporations to 70 or so.

And taking a look at my portfolio right this moment, there aren’t many extra that I’m very eager about promoting.

To me, nearly each firm above is contending for best-in-class standing and people are the varieties of corporations that I need to personal over the long-term.

Moreover, I’ve largely eradicated my publicity in the direction of sure industries that I used to be trying to get out of, so these trades are almost over with (exterior of some bio-pharma names that I would not thoughts promoting on the proper costs).

I might additionally contemplate promoting/trimming a number of of my REITs within the occasion that the Fed cuts charges and that sector catches a bid.

As I mentioned final November, I contemplate the brand new house to be part of the family’s funding portfolio general and since it’s going to improve our publicity to actual property, I’d be prepared to proceed to cut back REIT publicity to stability issues out.

Nonetheless, since REITs proceed to be out of favor I don’t thoughts holding onto low-weight positions like CPT or ARE till they expertise a rebound.

I’m additionally persistently asking myself, at what level do I take into consideration taking some Nvidia income off the desk?

I’m not in a rush to take action as a result of that firm stays one among my favourite progress shares; nonetheless, NVDA’s current rally has pushed shares up above my honest worth estimate and as shares strategy $1,000.00 I discover myself contemplating profit-taking increasingly more.

General, I really feel fairly good about my sector allocations proper now (I stay chubby expertise, which continues to be my favourite space of the market as a long-term investor).

Now, the most important factor that I’m wanting ahead to is probably extra dividend initiations from big-tech gamers (Alphabet, I’m taking a look at you).

If an organization like Alphabet or Amazon began paying a dividend, it might be a boon to my revenue stream.

I’m loving the development that I’m seeing within the expertise sector with regard to shareholder returns and I feel there’s loads to sit up for all through the remainder of the 12 months.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

from Finance – My Blog https://ift.tt/ZALtnye

via IFTTT

No comments:

Post a Comment