J Studios/DigitalVision via Getty Images

Come for the dividend stock picks, stay for the economic analysis.

Or come for the economic analysis and stay for the stock picks.

Or just read one section and skip the other. Whyever you’re here, let’s get to it.

The market has given us plenty to ruminate on, both on the economics side and (especially) on the dividend stock side, which has suffered yet another interest rate-driven selloff as of late.

It psychologically weighs on an investor when their own portfolio remains in bear market territory when the S&P 500 (SPY) is in full-blown bull mode. But remember: If you are like me and investing primarily to generate sufficient passive income when you need it (either now or in the future), then dividend stock price weakness is a long-term buying opportunity.

In a world focused only as far as the next year or so, thinking about and investing for the long-term is a competitive advantage.

Yes, it’s true that the future, especially beyond the next year or so, is unknowable. But if you think in terms of probabilities, you can put the odds on your side.

In the long run…

- High-quality assets

- Low-leveraged and well-structured balance sheets

- Skilled and shareholder-friendly management teams

- Long track records of strong performance and high returns on invested capital

…will ultimately prove their worth and compound their cash flows (and dividends).

Here’s today’s agenda:

- A slice of macroeconomic humble pie, served cold.

- Three primary drivers of economic growth in 2024.

- The 8 high-quality dividend stocks I’m focused on buying during the fourth week of April.

I Was (Effectively) Wrong On “Higher For Longer”

The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.

… Right now, given the strength of the labor market and progress on inflation so far, it’s appropriate to allow the restrictive policy further time to work.

— Jerome Powell, April 16th

In both investing and economic forecasts, it’s possible to be technically correct but effectively wrong.

For a while now, I’ve been arguing that the economy is gradually returning and will continue to return to a state of slow growth, disinflation, and lower interest rates. I continue to believe that.

As I showed in last week’s “Stocks I’m Buying The Third Week of April,” core and headline CPI rates have both been under 2% for the better part of a year if you just substitute the BLS’s lagged shelter component with real-time, private sector rent growth metrics.

Back out the CPI’s (and PCE’s) poorly formulated housing inflation measurements and inflation is already under control. Has been for a while. Truflation corroborates this.

In a different world where inflation was measured differently (in my view: correctly), the Fed would have started hiking rates much sooner and would already be in rate-cutting mode.

Alas, we don’t live in that alternative world.

Currently, we live in the world of “higher for longer,” or more accurately, “this high for a while longer.”

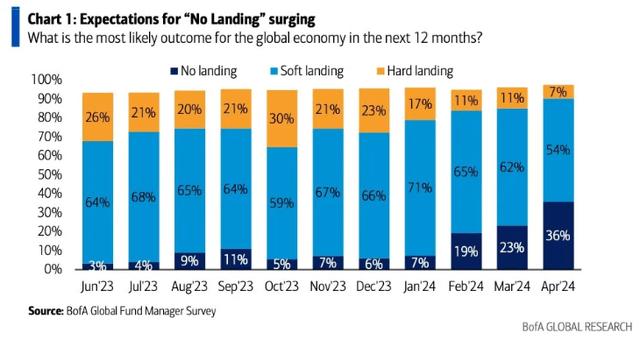

The market seems to interpret this as signifying that a “hard landing” or recession is becoming less likely.

Bank of America Global Research

I think the opposite. I think that the longer the Fed keeps monetary policy tight, the higher the odds of a recession.

Looking back at the history of monetary cycles, isn’t that commonsense?

Three Drivers of Economic Growth In 2024

Consumer spending accounts for a little over 2/3rds of US GDP, so consumption naturally plays a major role in the continued economic expansion in 2024.

But if you dig deeper into consumer spending, as Wells Fargo has recently done, you’ll find a more mixed picture of strength and, if not weakness, weakening trends.

I like to split American consumers into two sub-groups:

- Affluent Consumers: High-income, asset-rich, plenty of excess spendable income, typically homeowners, roughly 40% of households

- Paycheck-To-Paycheck (P2P) Consumers: Low- to middle-income, debt-burdened to varying degrees, little to no excess income, typically renters, roughly 60% of households

Affluent consumers are overwhelmingly insulated from both inflation and high interest rates. Their primary source of debt are mortgages, and most affluent consumers locked in 30-year mortgages at low rates over the last several years. And even though they spend more money on an absolute basis than P2P consumers, they also spend a lower percentage of their income, which makes them less sensitive to inflation than P2P consumers.

Unlike P2P consumers who are entirely reliant on pay raises to shoulder inflation, affluent consumers typically have excess labor income and passive income from real estate, stocks, money market funds, savings accounts, etc.

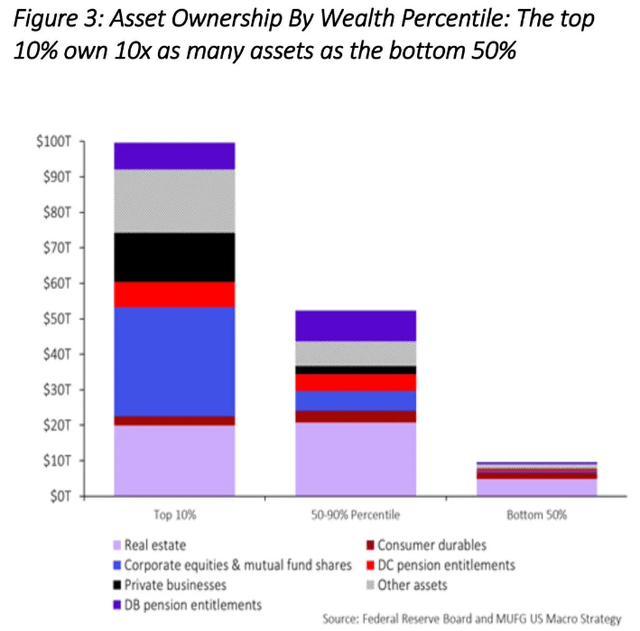

MUFG US Macro Strategy

This chart only shows assets, from which the affluent generate a lot of passive income. The bottom 50% of households by wealth, as you can see, collectively own about 6.25% of the nation’s assets and most of these generate little to no passive income.

plus, while affluent consumers typically have zero personal exposure to floating interest rates, P2P consumers are exposed to floating rates via credit cards, auto loans, and buy now pay later financing.

Thus, while high interest rates weigh on P2P consumer finances, they are beneficial to more cash-rich affluent consumers.

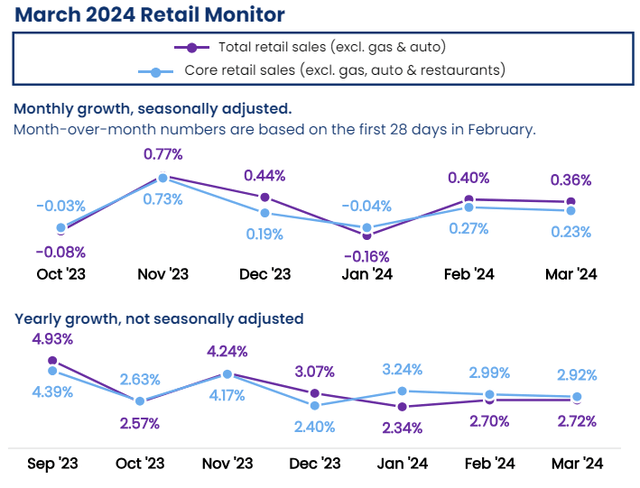

In today’s economy, affluent consumers are a significant driver of continued GDP growth. Even though retail spending growth has moderated, it remains about 3% YoY, according to the CNBC/NRF Retail Monitor, or about 4% according to the Department of Commerce.

CNBC/NRF

What about the American middle class, which historically has been the “make or break” for economic growth? According to recently released Morning Consult data, middle-income households are behaving more like low-income households than high-income ones, with their spending power weakened by high interest rates and prices continuing to creep higher.

Hence why consumer sentiment is significantly more positive for high-income folks than low- to middle-income folks.

Axios calls this the “two-speed economy”: “Rich Americans are spending at healthy rates, driving overall demand — but there are early signs that low- and middle-income consumers are starting to cut back.”

1. Affluent Consumers

Given the above, it should be unsurprising that affluent consumers are continuing to drive economic growth via their spending.

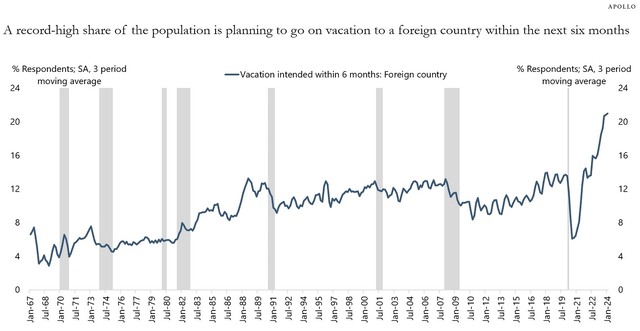

Here’s another proof point of their plans to continue spending:

The Daily Spark

An international vacation may not involve much domestic spending, but it certainly indicates that the affluent are feeling good and in a spending mindset. This is good for the US economy as well.

2. Consumer Debt

How are the “other half” continuing to spend money? In a word: debt.

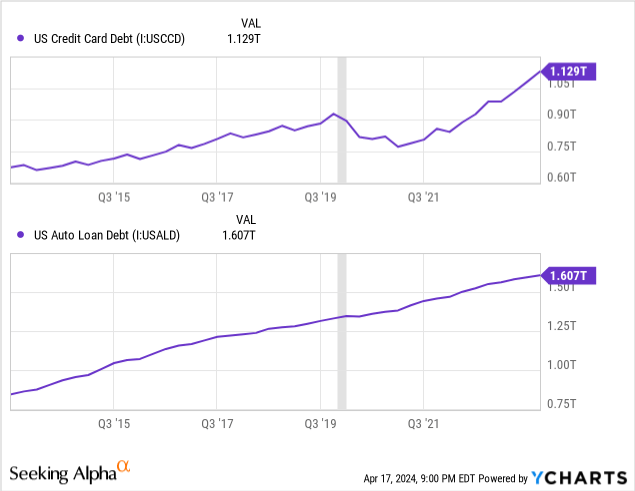

Credit card and auto loan debt are both at record highs and trending higher, indicating that P2P households have run out of pandemic-era stimulus money and now reliant on pay raises and credit cards to keep spending.

If consumer debt grew in line with disposable income, this situation would be sustainable, but that isn’t the case. Consumer debt is growing far faster than P2P households’ incomes.

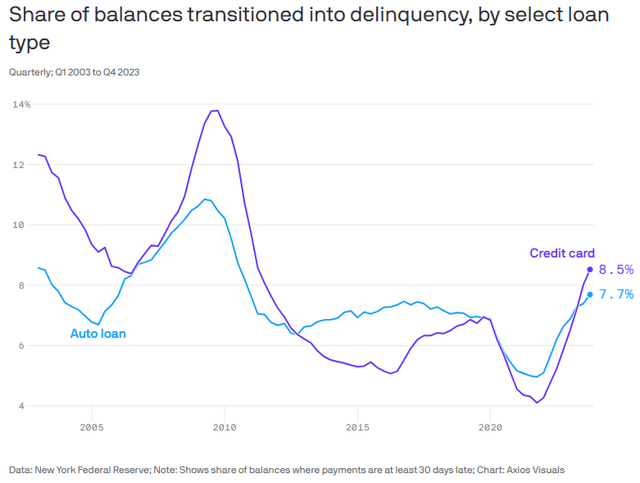

That’s why we are back in a cyclical upswing of consumer delinquency rates, both credit card and auto.

Axios

On top of delinquency rates rising, the share of credit cardholders making only the minimum monthly payments is also on the rise, recently reaching 11% of total accounts.

Delinquencies have begun to weigh on consumer spending, but the trends have a ways to go yet, based on how high delinquency rates got in the recessions of the early 2000s and the GFC.

3. Immigration

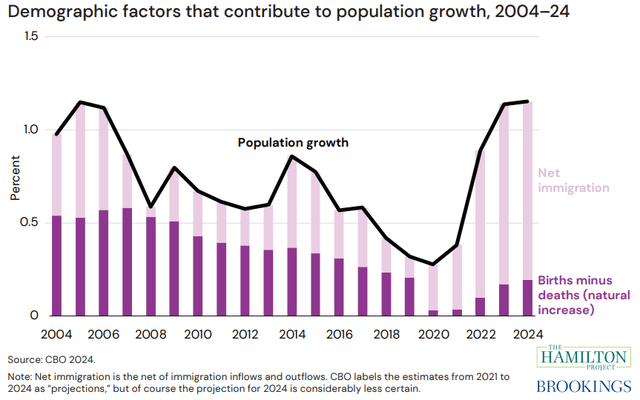

The Hamilton Project at the Brookings Institution estimates that US population growth is currently at its highest level since the mid-2000s due overwhelmingly to net immigration.

Hamilton Project at Brookings Institution

According to Ernie Tedeshi of Yale University, the increase in the US immigrant population since the beginning of 2020 “accounts for at least a fifth” of US real GDP growth, largely through boosting the labor pool.

Absent immigration, the US labor supply would have shrunk by 1.2 million since 2019. Instead, it expanded by 2 million.

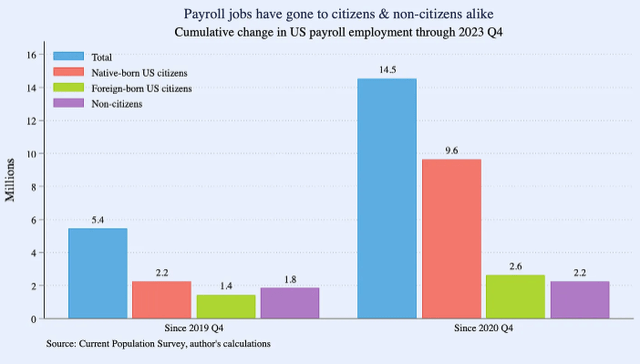

Here’s a chart that breaks out job gains (not accounting for losses or quits) across the native-born and foreign-born:

Ernie Tedeshi, Briefing Book

Immigrants, including low-skilled ones, have gone a long way to fill job openings that can’t find native-born workers.

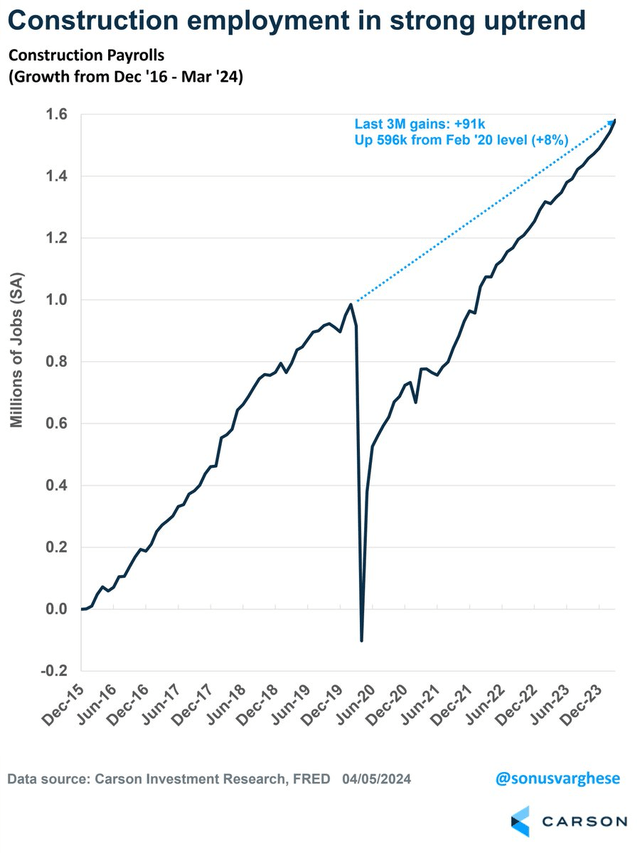

Consider that the construction industry, which employs among the highest share of foreign-born workers of any US industry, has seen some of the fastest job growth since COVID-19.

Carson Investment Research

Since the beginning of COVID-19, an additional ~600,000 workers have been hired to work in construction jobs.

Moreover, another industry with a very high share of immigrant workers is transportation & warehousing. There are ~761,000 more workers in transportation & warehousing today than in February 2020.

While surges of immigration such as what we’re witnessing today do come with negative effects, such as strain on local government budgets where immigrants congregate, the net economic effect of immigrants tends to be positive. There are multiple reasons for this:

- Immigrants increase the labor supply and fill job openings.

- Immigrant workers pay payroll taxes but lack access to most government benefits unless and until they are naturalized.

- Immigrants tend to be disproportionately hard-working and entrepreneurial, exemplified by their disproportionate share of new business formation and patent generation.

- Immigrants also spend money just like everyone else and contribute to consumption, which fuels the economic engine of America.

Yes, there are tradeoffs to this level of immigration. But the evidence suggests that having more people in the country who work and spend money has contributed to the surprising level of economic growth in the US.

8 Dividend Stocks I’m Buying This Week

In addition to the 8 stocks on my “buy” list (discussed below), a few stocks recently came back onto my “almost buyable” list.

The one that I already own is American Homes 4 Rent (AMH), a single-family rental REIT that owns a portfolio of almost 60,000 SFRs primarily in the Sunbelt and Midwest.

Uniquely, AMH also has a robust internal development platform capable of churning out some 2,000 build-to-rent homes per year at a much higher stabilized yield than what it could get by buying existing homes. Its primary competitor, Invitation Homes (INVH), lacks this in-house development capability, giving AMH a competitive advantage.

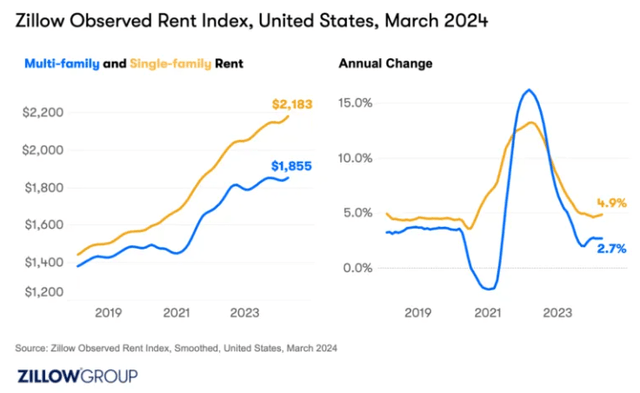

Unlike the overbuilt multifamily space, SFRs enjoy a much more favorable supply-demand balance, resulting in stronger rent growth.

Zillow

With the Millennial generation aging into their prime single-family phase of life and homebuying affordability out of reach for most, the supply-demand balance should continue to be favorable to SFR landlords like AMH for a long time to come.

AMH briefly touched a 3% dividend yield (20x core FFO multiple), where I bought a bit more of it last week, but it has since rebounded a bit as of Friday, April 19th. If it dips back below $35, it’ll be on my buy list.

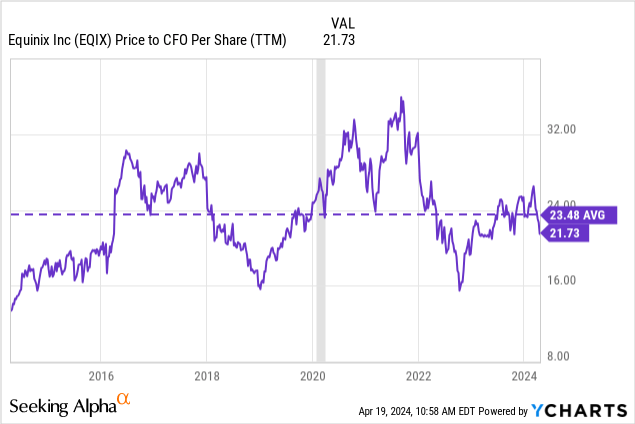

The other high-quality compounder, which I do not yet own, that was edging back toward buyable territory last week was Equinix (EQIX), the largest global data center REIT that has soared amid the AI boom.

But EQIX has shed over 18% of its stock price off its recent high, bringing its price to operating cash flow (directionally similar to AFFO) down below its 10-year average level.

The market’s caution is warranted, because EQIX won’t benefit from AI as much as specialized chipmakers, but the selloff looks overdone.

EQIX has a solid history of steadily generating 9-10% AFFO per share growth since its conversion to REIT status in 2015. But short seller Hindenburg Research has argued that EQIX misclassifies a lot of maintenance capex (included in AFFO) as growth capex (not included in AFFO), which would artificially boost their bottom line number.

I need to investigate this and ruminate on valuation before deciding whether to take a position in this data center juggernaut.

Now, onto the 8 stocks on my buy list this week. Here’s the rundown:

| Dividend Yield | 5-Year Avg. Ann. Div. Growth | Upside To 5-Yr Avg. Valuation | |

| American Tower (AMT) | 3.8% | 15% | 52% |

| Alexandria Real Estate (ARE) | 4.3% | 6% | 65% |

| Comcast Corp (CMCSA) | 3.1% | 9% | 44% |

| EastGroup Properties (EGP) | 3.2% | 13% | 28% |

| Mid-America Apartments (MAA) | 4.7% | 9% | 35% |

| Rexford Industrial (REXR) | 3.9% | 19% | 83% |

| Toronto Dominion Bank (TD) | 5.2% | 8% | 8% |

| Essential Utilities (WTRG) | 3.5% | 7% | 49% |

Note: The upside to 5-year average valuations for some of these, especially the high-multiple REITs, is partly this high because of how low interest rates were in 2019-2021. While I expect interest rates to decline in the coming years, I don’t necessarily expect them to return to 2019-2021 levels, which

To save time and prevent repeating myself from previous articles, I’ll link to the articles where I’ve pitched some of these in the past while focusing on the new additions to the buy list.

There are no changes to my investment theses for AMT, CMCSA, MAA, or WTRG from my pitches made in the first week of April, second week of April, and third week of April. They remain cheap (and have gotten cheaper) and I continue to build my positions in these high-quality compounders.

One quick point on MAA and its Sunbelt multifamily properties, which are seeing a large wave of new supply coming being completed in their markets.

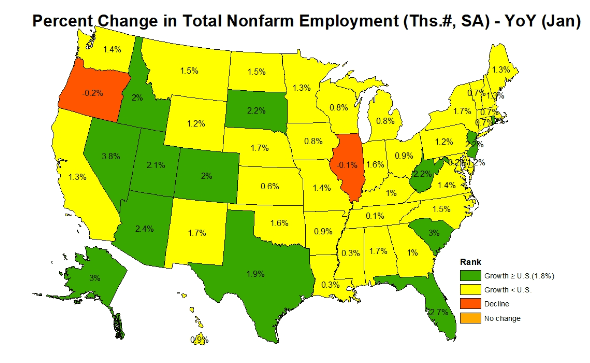

Many of MAA’s Sunbelt markets continue to enjoy above-average job gains, fueling solid absorption of the new supply.

BLS

According to the March jobs report, Texas added the most jobs YoY at 270.7k, followed by California at 217.7k and Florida at 211.1k.

Georgia (including MAA’s largest market of Atlanta) enjoyed a particularly strong March for job gains of 16.2k MoM and 55.4k YoY. The Carolinas, from which MAA also derives a large share of revenue, likewise continue to enjoy moderate job gains. And Virginia, where MAA has a strong presence in the suburbs of DC, also showed strong job gains in March at 16.5k MoM and 73.9k YoY.

In short, I think MAA is deeply undervalued, because I think high supply deliveries in its markets should be mostly met with high absorption from job growth and household formation.

Now, onto the others.

Alexandria Real Estate Equities (ARE)

ARE owns and develops state-of-the-art, Class A life science campuses in the most productive research clusters in the US. Its portfolio is mostly single-tenant, triple-net leased, and occupied by the world’s largest and strongest biotech companies.

The market seems to worry either that ARE is no different than a traditional office REIT or (more likely) that ARE’s life science portfolio is going to suffer a huge wave of increased competition from both ground-up construction and office-to-life science conversions.

The more pain office real estate feels, the more of these buildings will likely be converted to life science.

What I think the market misses is that ARE’s portfolio is truly best-in-class, typically located directly adjacent to top research universities across the nation. Its existing portfolio enjoys an 8-year average remaining lease term, and its development pipeline is already 60% leased or in leasing negotiations.

ARE should remain resilient through this cyclical slump.

EastGroup Properties (EGP)

EGP sold off in sympathy with Prologis (PLD), which recently issued relatively soft guidance for 2024 as tenant demand pulls back amid economic uncertainty.

PLD reported cash same-store NOI growth of 5.7% in Q1 2024 and guidance of 6.25-7.25% for the full year, but the (lowered) midpoint of its core FFO per share guidance for 2024 now assumes a decline of 3.4% YoY on the bottom line. Excluding net promote income, though, the midpoint of core FFO per share represents 7.8% growth this year.

So, basically, the whole industrial REIT sector sold off because growth looks like it will be slower than expected this year… but still not bad. That seems like market short-termism to me, indicating that this is a good buying opportunity for long-term investors.

Contrary to PLD’s national and primarily coastal portfolio, EGP is heavily concentrated in a handful of select Sunbelt markets like Dallas/Fort Worth, Phoenix, Las Vegas, Atlanta, Austin, and San Diego. These markets face more pressure from new supply, but EGP’s enviable infill locations insulate it somewhat from this competition.

Plus, EGP’s markets should greatly benefit from nearshoring and especially increased trade with Mexico.

Rexford Industrial (REXR)

REXR’s story is very similar to that of EGP. It sold off in sympathy to PLD. It looks extremely attractive at its current price for long-term investors.

While REXR’s Southern California markets don’t enjoy the same level of population growth as EGP’s Sunbelt markets, SoCal is also the most supply-constrained market in the nation. In Orange County, there is almost no development pipeline of new supply coming to market. Los Angeles isn’t much better.

This should ensure that the current pullback in tenant demand causes limited damage before the next round of frenzied leasing activity and rent growth begins.

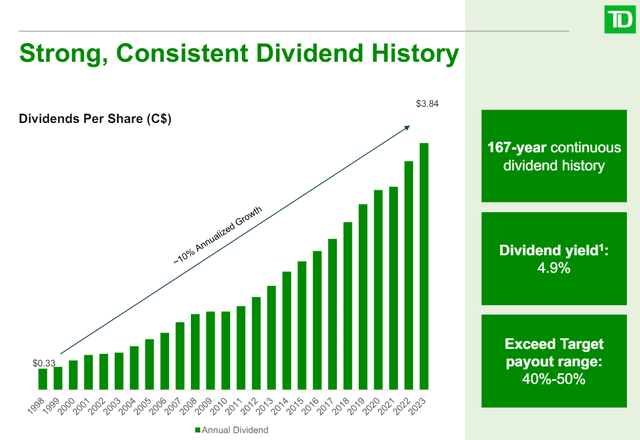

Toronto Dominion Bank (TD)

TD is one of the largest banks in Canada, a country with a highly concentrated banking sector, unlike the fragmented banking industry in the US that has thousands of banks from small community bankers to multi-faceted financial giants like J.P. Morgan (JPM) and Bank of America (BAC).

A culture of conservatism pervades the Canadian banking sector, and that is certainly true of TD as well. The bank has paid an uninterrupted dividend for 167 years while growing the dividend alongside the Canadian economy.

TD Investor Presentation

But TD has also expanded in the Eastern region of the US. In recent years, TD attempted to acquire US regional bank First Horizon (FHN), but the deal was scuttled amid the rapidly rising interest rate environment and regulatory issues.

Also, the stock has recently been quite sensitive to interest rates due to Canadian mortgages usually featuring fixed rates for only 1-5 years. Refinanced mortgages are leading to a rising tide of stress in the Canadian housing market.

So far, though, the Canadian housing market has held up. Home prices in Canada continue to rise like they do in the US. And homeowners seem to be capable of muddling through the current period of high rates.

I like how well-capitalized and financially conservative TD is managed. I like its geographic footprint and stated desire to keep expanding in the US. And I like its dividend profile, including a ~5.2% dividend yield and incredible track record of dividend growth.

from Finance – My Blog https://ift.tt/K4sqfYR

via IFTTT

No comments:

Post a Comment