EasterBunnyUK/iStock via Getty Images

The last time I looked at Bath & Body Works (NYSE:BBWI) was when Daniel Loeb sent a letter to the company’s Board of Directors highlighting issues he has identified in several areas, including corporate governance, capital allocation, and executive pay. This was just over a year ago, and at the time, I thought the company was well-positioned for long-term growth despite facing short-term challenges including inflationary pressures. Since then, BBWI stock has gained almost 50%. On the back of this stellar performance and the mounting macroeconomic pressures, Bath & Body seems fairly valued going into first-quarter earnings.

Bath & Body Works Q1 – A Weak Earnings Print Is On The Cards

Bath & Body Works is scheduled to report first-quarter (Fiscal 2024) earnings on June 4. Wall Street analysts project Bath & Body’s EPS to remain flat compared to the previous year at 33 cents. Analysts have been forced to revise earnings expectations to the downside over the last year or so given the inflationary pressures Bath & Body has been facing. The company itself has slashed sales forecasts amid these macroeconomic challenges.

During the Q4 earnings call, Bath & Body mentioned that macroeconomic pressures will dampen the demand in the first half of the current fiscal year.

We are seeing macroeconomic pressures continue and our largest product category, candles, continues to normalize. Taking headwinds and tailwinds into consideration, we expect net sales and operating income to be down on a year-over-year basis as we begin the year. We then expect to see net sales inflect and begin to grow during the second half of the year.

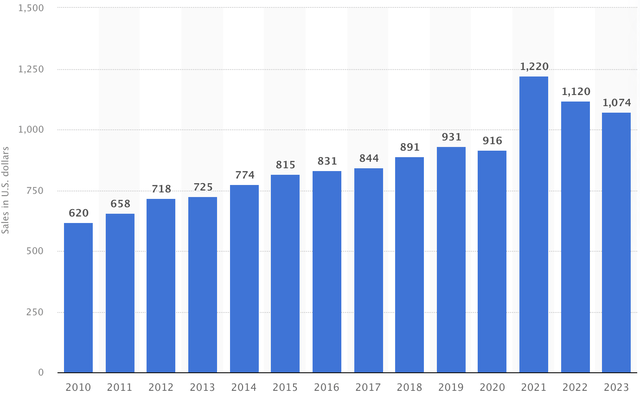

In the upcoming earnings report and earnings call, the management is likely to shed more light on how inflation is affecting sales growth and profit margins. Investors will also have to focus on trends in foot traffic to assess the demand outlook. In contrast to many retail brands, Bath & Body continues to attract substantial foot traffic to its stores around the world, which comes down to its strategy of focusing on specialty malls where consumers are likely to spend more money in comparison to larger malls. As illustrated below, sales per average selling square foot have trended higher since 2010.

Exhibit 1: Sales per average selling square foot

Statista

The expected weakness in the first fiscal quarter, however, has not deterred investors from betting on Bath & Body’s long-term prospects. BBWI stock is up almost 50% in the last 12 months, including a 20% jump this year. To evaluate the long-term prospects for the company, the most important step is to understand demand trends.

A Slowdown Is Inevitable For BBWI

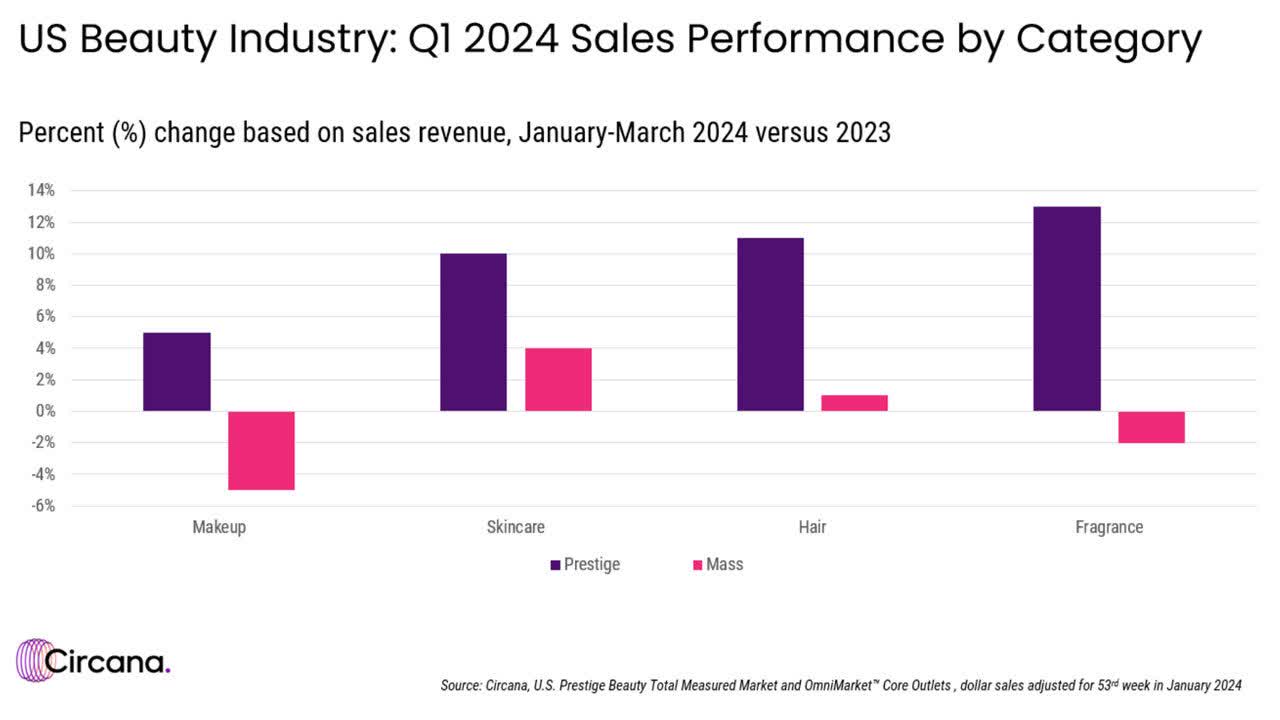

Bath & Body’s prospects are closely tied to the demand environment for the domestic beauty industry, which includes bath and shower products, body care products, and fragrances. In the first quarter, U.S. prestige beauty products sales grew 9% YoY despite macroeconomic pressures. However, mass-market beauty sales increased just 2% YoY, highlighting the outsized impact inflationary pressures are having on the average consumer. As illustrated below, mass-market product sales lagged behind prestige sales across all categories in Q1.

Exhibit 2: U.S. beauty industry sales

Circana

Bath & Body Works, as a household name, will see some pressure on sales in the foreseeable future as consumer spending slows. The company, however, is on better footing compared to many retailers that are likely to see a bigger impact from a slowdown in consumer spending. Last April, Wells Fargo analysts found Bath & Body among the few names that would continue to see strong demand for products despite a general slowdown in the sector.

Competitive Advantages Support Long-Term Growth

Bath & Body has carved out competitive advantages through innovation. The company has built a reputation for high standards of customer servicing, engaging in-store experiences, and also frequent sales events but the one factor that has contributed the most to its strong brand loyalty is constant innovation. During the Q4 earnings call, company executives mentioned “innovation” 8 times, which serves as a testament to Bath & Body’s commitment to keeping loyal customers hooked.

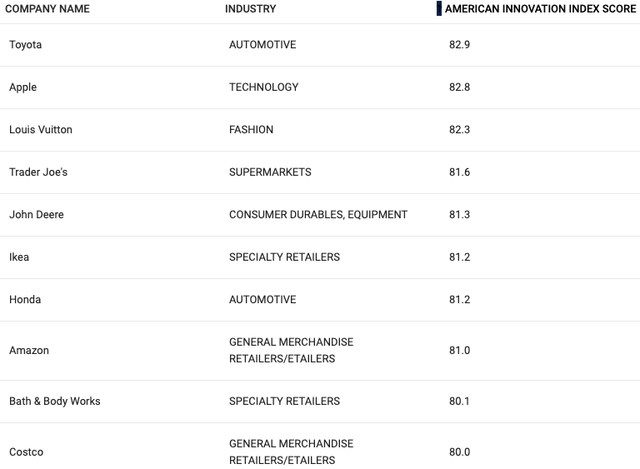

Fordham University’s American Innovation Index recognized Bath & Body as one of the top 10 innovators in 2023, and the company joined an elite list of brand names including Apple, Inc. (AAPL) and Louis Vuitton (OTCPK:LVMHF).

Exhibit 3: Top 10 innovative companies in 2023

American Innovation Index

The company’s strategy, over the years, has been to bring new fragrances to the market every four to six weeks, refreshing the product suit while responding to changing consumer preferences in near real-time. This has been the key ingredient to Bath & Body’s competitive advantages. My wife, whenever she visits the mall, drops by the Bath & Body store as well and often ends up purchasing “newly launched” products. The never-ending pipeline of new products has successfully hooked customers to the brand, which I believe will help the company earn economic profits in the foreseeable future.

With almost all the key end markets targeted by Bath & Body – home fragrance, body care, hand soap, and hand sanitizer – poised to grow in the next decade, Bath & Body’s strong brand loyalty should help the company post steady revenue growth.

Bath & Body’s diversification efforts will also pay off in the coming years. The increasing focus on men’s grooming products is an interesting development as the company has historically targeted women. This new strategy is already opening doors for Bath & Body to grow by expanding its addressable market opportunity.

Takeaway

Bath & Body Works’ earnings report tomorrow will likely have a muted impact on the stock unless the company slashes its guidance for the full fiscal year due to dampening demand. The biggest short-term threat I see is a continued weakness in the consumer, which may force the company to reset the guidance for upcoming quarters. At a forward P/E of 15.72, Bath & Body is trading in line with the consumer discretionary sector average of 16.33. While this suggests the company is fairly valued from an industry valuation perspective, I would not be surprised if Bath & Body sees a meaningful expansion in valuation multiples in the long run given its superior margin profile compared to closest rivals. That said, I am maintaining my hold rating for BBWI going into earnings as I believe the company will face headwinds this year, forcing the market to re-rate Bath & Body, presenting investors with a more attractive risk-reward profile.

from Finance – My Blog https://ift.tt/6mewJUq

via IFTTT

No comments:

Post a Comment