PierreOlivierClementMantion/iStock Editorial via Getty Images

Movado Group, Inc. (NYSE:MOV) designs, sources and sells watches through the company’s Movado, Concord, Ebel, MVMT, and Olivia Burton brands, and owns some retail stores through which the company sells watches in addition to ecommerce. More of the company’s revenues come from licensed brands, which currently include Calvin Klein, Coach, Hugo Boss, Lacoste, and Tommy Hilfiger.

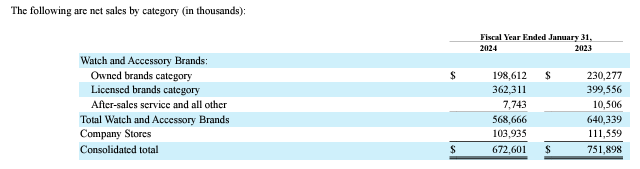

Movado’s Sales by Category (Movado Group FY2024 10-K Filing)

The stock hasn’t had a great performance in the past decade, as the stock has lost around a third of its value. Movado does pay out a good dividend, though, and has a good yield of 5.48% at the time of writing.

Ten Year Stock Chart (Seeking Alpha)

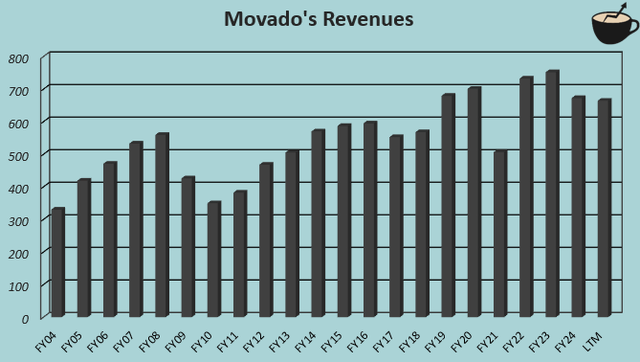

Long-Term Financials Show Modest Growth

From FY2004 to FY2024, Movado’s revenues have grown at a CAGR of 3.6%, showing some turbulence in the growth but an overall good performance. The growth has been organic, as well as boosted by the 2017 acquisition of Olivia Burton and 2018 acquisition of the MVMT brand.

Author’s Calculation Using TIKR Data

Margins have historically followed sales trends quite well, and the current trailing operating margin stands at a healthy 7.1%, down dramatically from 16.1% from in FY2023 due to lower sales.

Is the Current Weakness Temporary?

As can be seen, revenues have taken a large step down in FY2024. Past turbulence has been caused by the introduction of the Apple Watch in FY2017 and the pandemic, but the current downturn seems to only be related into a challenging retail environment as told in the Q4/FY2024 press release. I am skeptical of the relation, though – Statista’s market insights into the watch market show 14.7% growth from 2022 to 2023 (nearly Movado’s FY2023 to FY2024) in the market’s revenues, especially driven by non-luxury watches’ growth that Movado’s brands mainly represent.

Some of Movado’s brands face scrutiny especially from watch enthusiasts – for example, the Movado brand’s luxury positioning faces criticism as its quartz movements are priced aggressively, and many of the watch designs are called uninspired. Many other brands in the portfolio also seem to attract similar criticism – I believe that the downturn likely in part represents a falling competitiveness in the industry, with both licensed and owned brands, and both U.S. and international operations showing a similarly bad revenue performance in FY2024 as per the fiscal year’s 10-K filing.

For FY2025, Movado has announced an outlook for sales of $700-710 million, and the outlook was reaffirmed with Q1 results where the company’s revenues continued to decline by -5.7%. The full year revenue outlook’s middle point represents a growth of 4.8%.

Significant improvements in sales are expected in the back half of the fiscal year due to increased marketing efforts – Movado plans $25 million in incremental marketing spend in the year to aid sales, predominantly affecting H2. The higher spent causes for a weaker operating income guidance of $32-35 million compared to $54.7 million in FY2024. Also, while the higher marketing spend will inevitably achieve at least some aid in helping revenues, the return on the marketing spend is yet to be seen – the guidance in sales could still easily be missed if the marketing campaigns aren’t successful. The increased marketing spend also doesn’t seem to be a sustainable way to aid sales, as it worsens profitability considerably.

To summarize, I believe that Movado’s offering experiences weakness in the industry, and has led to weak sales while overall non-luxury watch sales have increased in 2023. The company expects growth in the back half of FY2025 due to an increased marketing spend, but the more aggressive marketing seems to be a short-term effort with more fundamental issues and weakens profitability very notably.

Licensed Brands’ License Expirations Are a Moderate Risk

Licensed brands, accountable for 53.9% of Movado’s total sales in FY2024, rely on licenses from the globally recognizable brands – the expiry and renegotiation of licenses is a significant risk that Movado faces.

The Coach brand’s license expires on the 30th of June in 2025 – the license expiration poses a mid-term risk. As the partnership with Tapestry (TPR) was launched way back in 1999, though, I don’t believe that a significant change to the downside in the license terms is highly likely.

The Tommy Hilfiger license expires at the end of calendar 2024, and can be extended by five years if the sales reach minimum requirements and the approval of a new business plan. Movado plans to submit a new business plan in the first half of FY2025 – investors could quite soon hear news about the license’s renewal. The brand partnership was also launched way back in 2001.

The Hugo Boss license expires at the end of 2026 but is extendable by five years if certain conditions are satisfied, the same as the Calvin Klein license that was launched at the start of calendar year 2022. The Lacoste license only expires at the end of 2031.

The license relationships have already been long, excluding Calvin Klein, and I don’t see any license changes as a very likely risk for the time being. Yet, I do believe that investors should be cautious about the potential – especially as Movado’s licensed brands’ sales have continued to decline, the licensors could potentially find better licensee opportunities with other partnerships.

The Strong Balance Sheet Needs Use

Movado’s balance sheet currently reveals $225.8 million in cash and short-term investments combined, nearly 40% of the company’s current $567.7 million market cap – while Movado plans to leverage the balance sheet for strengthening the competitive position, Movado’s still healthy cash flows should be able to aid increased investments by themselves.

As such, I believe that a special dividend, faster share buybacks, or new M&A could be potentially great moves for Movado. After Q1, the company still had $16.8 million left under a share repurchase program, representing quite a small amount of the total cash.

Valuation: Cheaper for a Reason

Movado’s stock currently trades at a forward P/E of 20.2 as the earnings are expected to be pressured by higher marketing in FY2025. I believe that the weak underlying sales performance likely requires continued investments, though, and a significant recovery isn’t likely due to the previously discussed factors.

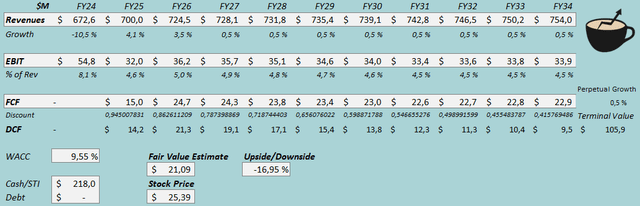

To estimate a rough fair value for the stock, I constructed a discounted cash flow [DCF] model. In the model, I estimate the lower bound of the FY2025 guidance, and a continued 3.5% growth in FY2026 due to higher marketing. Afterwards, I only expect 0.5% growth due to the weak underlying performance.

For the EBIT margin, I estimate the lower bound of 4.6% in FY2025, but an improvement into 5.0% in FY2026 due to the estimated better revenues. Afterwards, I estimate the revenue weakness to cause a fall into 4.5%, though. Movado’s business model revolving around third-party sourcing is very capital light, making the company’s cash flows predictably healthy.

DCF Model (Author’s Calculation)

The estimates put Movado’s fair value estimate at $21.09, 17% below the stock price at the time of writing – the weak underlying performance pushes the fair value below the stock price despite the strong balance sheet, representing an unattractive investment if sales don’t organically perform better.

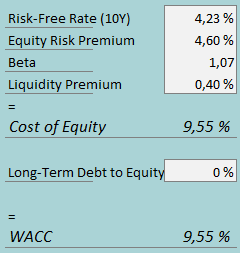

A weighted average cost of capital of 9.55% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Movado doesn’t hold any interest-bearing debt excluding minimal lease interest, and I estimate the long-term debt-to-equity ratio at 0%. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.23% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Yahoo Finance estimates Movado’s beta at 1.07. Finally, I add a liquidity premium of 0.4%, creating a cost of equity and WACC of 9.55%.

The Main Upside Risk

Improving sales could easily turn the investment case attractive – with the average operating income of $61.2 million achieved from FY2016 to FY2020, the stock would already be highly attractive at the current price. The main driver is expectedly Movado’s brands’ performance, and the higher marketing spend could pay off for the brand equity.

I still suggest investors to keep a close eye on the sales performance as improvements could make for a very valuable investment case, but to me, it seems that investors shouldn’t hold their breath waiting for a turnaround. Insiders have sold stock for $969 thousand in late 2023, also suggesting a more unlikely recovery.

Takeaway

Movado’s brands seem to be underperforming in the watch market, and the long-term modest growth has turned into revenue declines in FY2024 and early FY2025. While Movado’s sales outlook for FY2025 suggests growth, it is a result of increased marketing spend that nearly halves the expected operating income for the year. The increased marketing spend seems to be a distressed attempt at improving sales with many fundamentally underperforming brands, and I believe that further sales weakness in the long term is likely at the moment. License expirations also pose a modest risk, especially due to weakening sales. As such, the current valuation still seems unattractive despite a strong balance sheet – I initiate the Movado Group stock at Sell.

from Finance – My Blog https://ift.tt/D6IrtO9

via IFTTT

No comments:

Post a Comment