Bill Oxford

Today, we are putting Cogent Biosciences (NASDAQ:COGT) in the spotlight for the first time since our look at this clinical stage biotech concern back in September 2022. Updated data from a late-stage study in late May gave the stock a bit of a boost. Can the rally continue? An updated analysis follows below.

Seeking Alpha

Cogent Biosciences is headquartered just outside of Boston in Waltham, MA. The company is focused on developing precision therapies for genetically defined diseases. Currently, the stock trades just south of nine bucks a share and sports a market capitalization of just above $900 million.

May 2024 Company Presentation

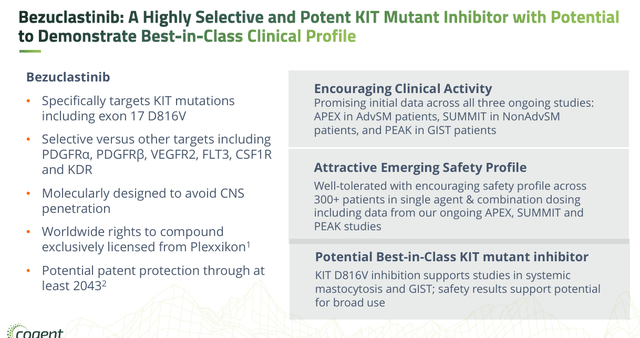

The company’s lead product candidate is dubbed bezuclastinib, also known as CGT9486, which it licensed from a company called Plexxikon Inc. Bezuclastinib is a selective tyrosine kinase inhibitor designed to target mutations within the KIT receptor tyrosine kinase. These mutations are found in approximately 80% of patients with advanced gastrointestinal stromal tumors. Cogent has some other compounds in pre-clinical development, but this analysis will be confined to the advancement of bezuclastinib.

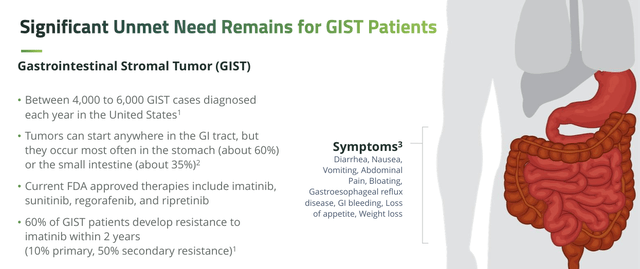

CGT9486 has been designed to be a potent and selective inhibitor of KIT Exon 17 mutations, both as a monotherapy and as part of a combination therapy with compounds that inhibit additional KIT mutations. In Phase 1/2 trial evaluating bezuclastinib in combination with sunitinib to treat advanced Gastrointestinal Stromal Tumors or GIST, the combination therapy median progression-free survival [PFS] reached 11 months. Most of these patients had been heavily treated with previous treatments, it should be noted.

May 2024 Company Presentation

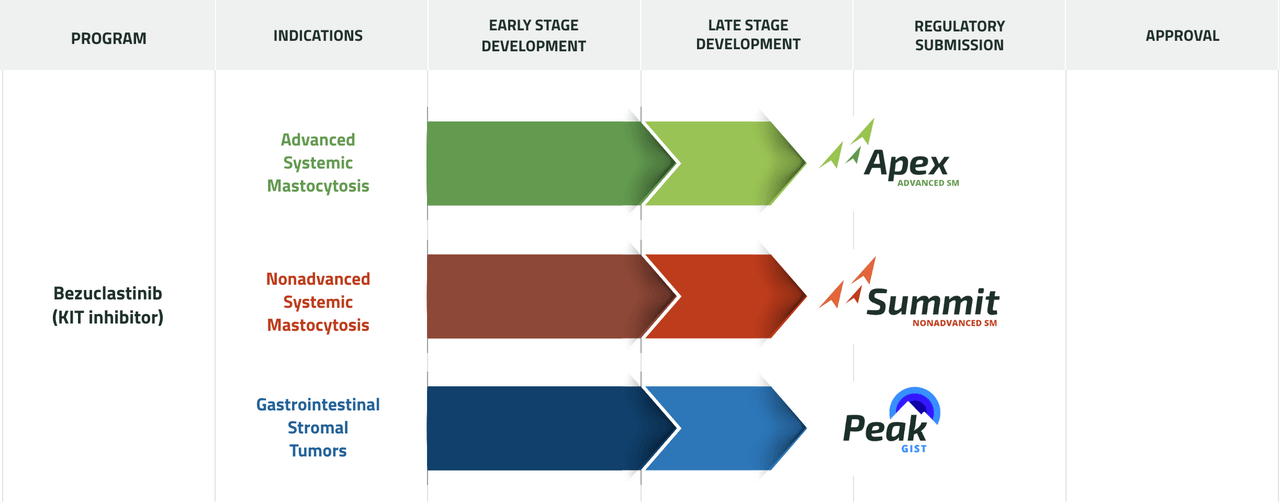

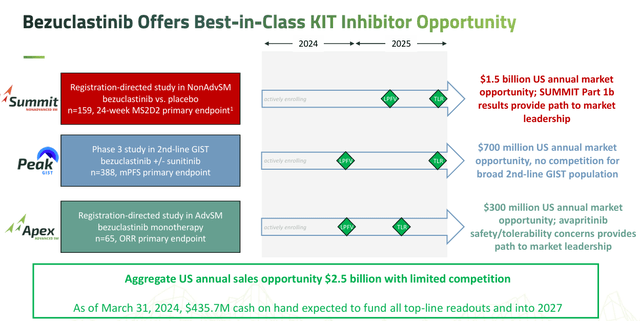

A pivotal trial for this combination therapy has been initiated. Enrollment should be complete by the end of this year and topline results from this late-stage study ‘PEAK’ should be out near the end of 2025.

Company Website

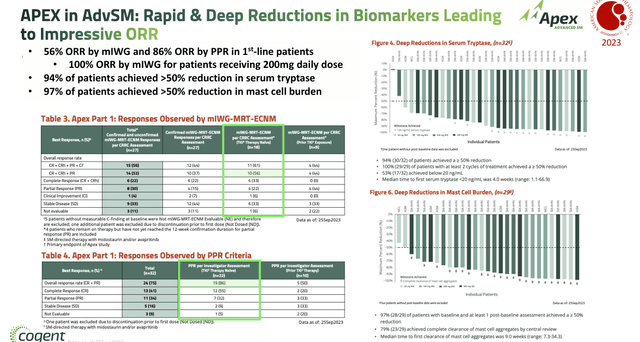

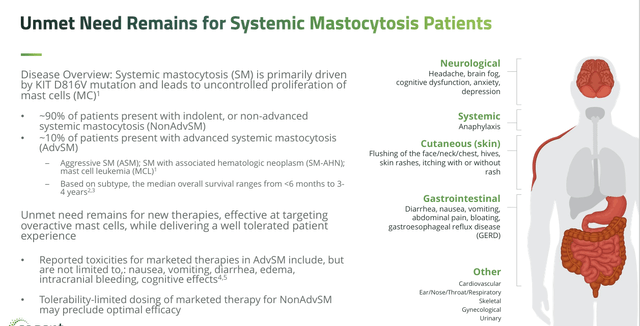

2025 is shaping up to be a potential ‘inflection year‘ for Cogent Biosciences. In addition to the PEAK study, bezuclastinib is being evaluated in a registrational, open label, multi-center trial ‘APEX’ as a monotherapy to treat Advance Systematic Mastocytosis or AdvSM. The compound has shown encouraging results in earlier stage development.

May 2024 Company Presentation

Management pegs the potential market for AdvSM in the $1.5 billion range, and there are unmet needs for this indication. Top line results from APEX should be out sometime mid-year in 2025.

May 2024 Company Presentation

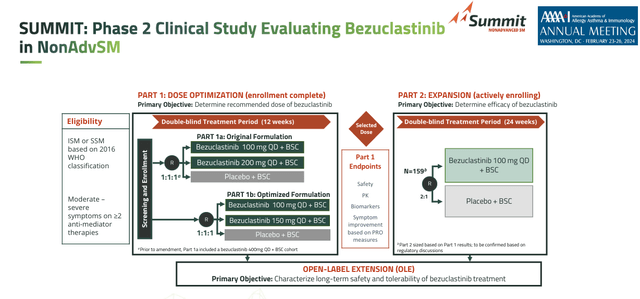

Bezuclastinib is also being developed as a monotherapy to treat Non-Advance Systematic Mastocytosis and is being evaluated in a registrational trial ‘SUMMIT’ for that indication. Bezuclastinib has demonstrated some solid results against this indication in earlier studies. Top line results from the SUMMIT trial are scheduled to be out towards the end of 2025.

May 2024 Company Presentation

Analyst Commentary & Balance Sheet:

Since updated trial data came out on May 24th, four analyst firms, including Piper Sandler and Needham, have reiterated Buy ratings on the stock. Price targets proffered range from $18 to $22 a share. Wedbush maintained its Hold rating and $10 price target on COGT.

After posting a $58.3 million net loss for the first quarter, Cogent had roughly $435 million of cash and marketable securities on its balance sheet. Management has stated this is enough to fund all planned activities into 2027. There has been no insider activity in the stock so far in 2024. The last insider sale of the shares occurred more than three years ago.

Conclusion:

May 2024 Company Presentation

Cogent Biosciences, for the most part, has all its eggs in one basket as its only real asset at this point is bezuclastinib. That said, it is evaluating that compound to treat three indications that have decent sized markets. The company is well funded to get through all three late-stage trials involving bezuclastinib, although I would imagine the company would raise additional capital to support the marketing launch of bezuclastinib if and when approved.

The company enjoys solid support in the analyst community, and insiders are holding tight to their stakes. With an under $1 billion market capitalization versus the size of the potential markets for bezuclastinib; COGT seems to merit a small holding pending further developments. 2025 is shaping up to be a make-or-break year for the company, but one that has much potential.

from Finance – My Blog https://ift.tt/KYlsItf

via IFTTT

No comments:

Post a Comment