RichLegg/iStock via Getty Images

Summary

I am positive on Auction Technology Group (OTCPK:ATHGF) [ATG]. My summarized thesis is that ATG is well positioned to benefit from the behavioral shift in the auction market (to online), as there are compelling advantages to doing so. As the leading player, ATG benefits from scale and reputation, which led me to believe it can at least grow in line with the industry.

Company overview

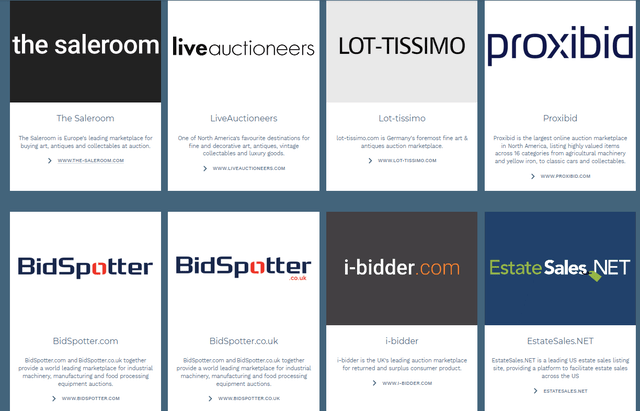

ATG operates a total of eight marketplaces for online curated auctions, with six in Europe, one in North America, and one in the US. The key segments that ATG focuses on are Arts & Antiques [A&A] and Industrial & Commercial [I&C] auction markets. The A&A segment is mainly for second-hand item categories., while the I&C segment is mainly for commercial property, warehousing, used machinery, and equipment. The other parts of the business, which are small (less than 10% of revenue), are auction services (white-level operations) and content (Antiques Trade Gazette paper and online magazine).

ATG

.

Auctions are shifting online as well

Just like many other industries that are adapting to the online world, the auction industry is moving in the same direction as well. To start off with some numbers, the estimated growth forward is from high single-digits to low teens until the end of this decade. I believe this growth is possible, given the value propositions.

Regarding the value proposition, COVID was a game changer for the industry. In the past, there wasn’t really any motivating factor to adopt online auctions, as frequent sellers and bidders are very well aware of how the industry works and are used to the old ways (because it works and viewing the product on site is safer). However, COVID disrupted the usual way of doing things (because of the lockdown) in that it forced all players in the value chain to step outside of their comfort zone to adopt online tools. This basically requires both sellers and bidders to: (1) gain awareness of how online auction sites work; (2) learn that online auction sites are trustworthy and can work; and (3) adopt new business practices to cater to online auctions.

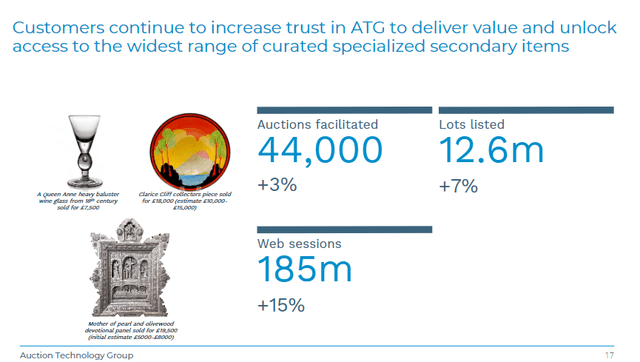

According to the 2023 Hiscox Online Art Trade Report, it was noted that online buyers and sellers have become familiar, and that familiarity has increased the trust in online platforms.

I believe a large part of the auction market is going to shift online over the coming years, as the model provides several compelling advantages for bidders, sellers, and the auction house. First of all, it significantly expands the addressable market that both bidders and sellers can target. In the past, it mostly targeted the locals (and maybe some people from places farther away) because of logistical reasons. However, online, the world is the limit. Anyone with an internet connection is able to participate. Secondly, from a bidder’s perspective, the new auction business model allows for a more convenient and private auction setting, as they could access auctions across multiple geographies at any time (this links back to my first point that the addressable market has gotten bigger). Lastly, for the auction houses, the shift online enables them to maximize their operational efficiency as they can run multiple auctions with minimal labor (a physical auction is labor-intensive as you need people to host, plan and organize, and attend to bidders and sellers, etc.). Online auctions also allow auction houses to conduct timed auctions (auctions taking place over a specified period online remove the costs associated with managing physical auctions).

Also, specifically for the I&C market, which has multiple sub-markets (manufacturing, construction, agriculture, real estate, etc.), I believe online auctions have a lot of room to grow because they basically open up another viable channel to source secondary assets (especially in downcycles where businesses go bust and have a lot of liquidation and insolvency sales). Sellers benefit as they are able to liquidate inventories to get back cash (without going through a fire sales process).

Leading player in the industry

ATG

ATG

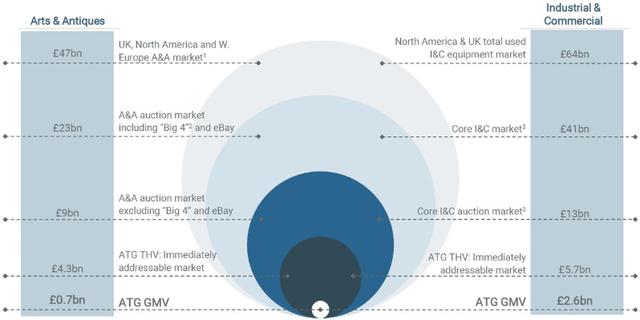

The markets that ATG targets are extremely huge as well. As per management estimates, the immediate addressable market [IAM] for its targeted verticals (A&A and I&C) is worth around GBP10 billion (in terms of gross merchandise value), and of this TAM, ATG currently has around ~33% market share. Having a large market share is a competitive edge because ATG essentially operates as a marketplace, and in order for it to scale, ATG needs to have both bidders and sellers, given that they attract each other. The more sellers (supply of goods), the more bidders (more supply attracts more consumers), and ATG benefits from this virtuous cycle. Importantly, the bigger the presence ATG has, the more reputable it becomes. The biggest stigma about online auctions is whether they are trustworthy, so having a good reputation is a big competitive advantage that cannot be easily replicated (it takes time to build up a good reputation).

Very cash flow generative business

Another aspect that I believe makes ATG really attractive is its ability to generate a lot of free cash flow. At the P&L level, ATG has always been profitable, and it has managed to expand its adj EBITDA margins significantly from 18% in FY18 to 47.3% in FY23, clearly showing the positive impact of having a large scale. Given the asset-light nature of the business, ATG was able to convert a significant chunk of adj. EBITDA to free cash flow (65% over the past two years). Therefore, while the ATG balance sheet is in a net debt position (GBP 145 million, including leases), I am not too worried about this at all. ATG can easily fund its debt position with operating cash flow (no risk of capital raising).

Valuation

ATG

Source: Author’s calculation

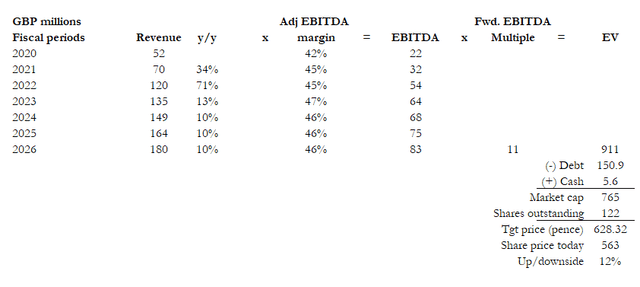

I believe ATG is worth 628 pence. My model target price of 560 pence is based on FY26 GBP83 million in adj. EBITDA and a forward adj. EBITDA multiple of 11x.

Earnings bridge:

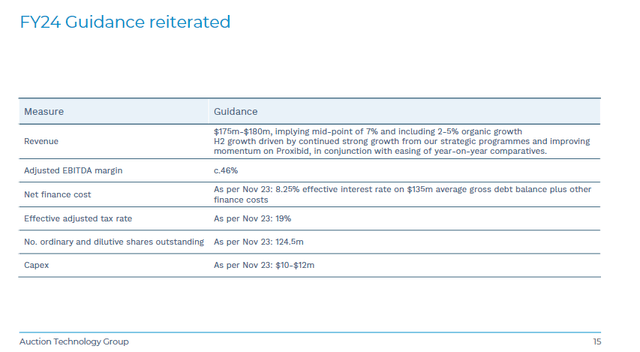

As ATG already has a large market share position, I believe its growth is very likely to mirror industry growth (at around 10% CAGR) moving forward. There is a possibility of further market share gains as ATG scales larger, but I have adopted a more conservative modeling approach. As for adj EBITDA margin, I believe there is little upside for the margin to expand further given that the gross margin is between 60 and 70%. As such, I modeled flat adj EBITDA margin forward, similar to management’s FY24 guidance.

Valuation justification:

I have compared ATG to two other companies with similar business models: Aramis Group SAS and eBay (EBAY), and they trade at 11x and 9x, respectively. ATG should trade closer to or even higher than Aramis as it has a higher adj. EBITDA margin profile (ATG at 46% vs. Aramis at near 0%) and a similar revenue growth profile. Compared to eBay, ATG should trade at a premium as it screens better on both margin (eBay has a 20+% adj. EBITDA margin) and growth (expected to grow mid-single-digits ahead). For modeling purposes, I am assuming ATG will trade at 11x forward EBITDA (its past 1-year average).

Investment Risk

Physical auctions will likely always feature in certain important markets, especially the very high-value items in the A&A segment, so there is a limit to ATG growth potential. Reputation is key to ATG, and if any of their sites have fraudulent items or scandals involved, it could impair the business growth outlook as sellers and bidders look elsewhere to conduct their transactions.

Conclusion

My positive view on ATG is because I believe it is well-positioned to benefit from the ongoing shift towards online auctions. ATG has a leading position in the markets it targets, and I see this is as a strong competitive advantage. Aside this, ATG is also very profitable and cash flow generative. I believe it should trade at 11x forward adj EBITDA given its better margin profile.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

from Finance – My Blog https://ift.tt/LJONcYq

via IFTTT

No comments:

Post a Comment