KanawatTH

The next section was excerpted from this fund letter.

Forex Change Worldwide (OTCPK:CURN)

CURN was a superb performer for us in 2023, up virtually 11.0%, although down about 12.0% from its winter 2023 highs. Operationally, the yr was a combined however largely optimistic bag. The firm continued to develop its revenues, up 21.0%, on the again of robust 23.0% Banknote section income progress, as the corporate continued to considerably develop its bodily footprint, seen within the desk under. Moreover, the strategically necessary Banknote Wholesale subsegment grew 31.0% in the USA, representing over 35.0% of total revenues, reaching virtually $30mm.

The Funds section income grew a barely disappointing 15.0%, however the greater factor to notice on the yr was the 30.0% progress in working bills, resulting in a flat $19mm Earnings Earlier than Curiosity and Taxes (EBIT) yr. Segmenting out the $14mm+ working expense progress, the will increase accounting for many of the expansion got here from salaries, transport, and supposedly one-time losses and shortages of virtually $3mm. The latter expense is a small purple flag.

Nonetheless, for 2024 and past, transport prices have been mitigated with pricing will increase, and salaries are an funding in future progress from which we anticipate substantial working leverage on future income will increase. It’s virtually unattainable to anticipate linear progress in profitability in small-cap firms. The Worth Line earnings high quality scores of 90+ are reserved for predictable large-cap firms like Johnson & Johnson.

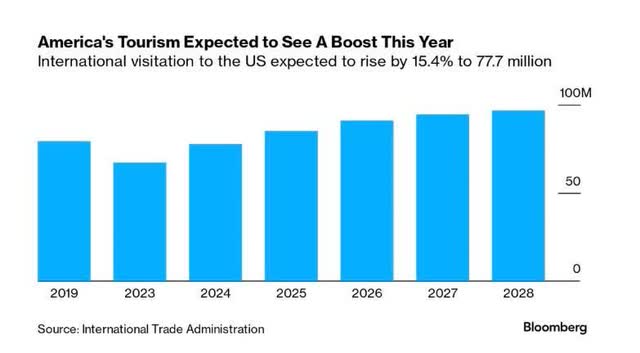

As such, we’re assured that with 2023 expense investments in salaries; a brand new Enterprise Useful resource Planning (ERP) software program; in addition to continued progress in revenues, the corporate ought to attain $95-100mm in revenues and $25mm-$30mm in EBIT within the subsequent 12-18 months. These outcomes must be bolstered by the continued tailwinds in American tourism that’s anticipated to continue to grow in low single digits, as seen within the chart on the following web page; continued market share features in retail and wholesale; in addition to the corporate starting to extend pricing given its market share and present, what we consider, product underpricing.

Which brings us to our efforts in serving to to deliver this $115mm market capitalization firm, with $82mm in whole internet money (of which roughly $50mm is working capital money wanted for operations), that generates over $20mm in high-growth EBIT, to raised allocate its capital. As you have seen in our memo to the corporate, which we shared with you throughout 2023, we believed that persevering with to construct up money on the stability sheet whereas the corporate is buying and selling at 1.5X EBIT and producing excessive teenagers returns on capital was extremely inefficient.

After a prolonged forwards and backwards trade with administration, in November 2023, the corporate introduced a inventory buyback of 5.0% of its shares. Whereas the scale of the buyback is tempered by Canadian inventory trade guidelines, we consider this motion to be an important first step. Whereas, after all, spending $6-7mm a yr at present inventory costs to scale back the share depend by 5.0% a yr is an enormous step in the fitting course by itself, we consider the optics of a administration staff that’s each starting to grasp the significance of capital allocation and listening to its shareholders are the extra necessary indicators to the market.

Whereas we now have no illusions about present small-cap valuations, on this specific case, bringing “our CURN boat to the river,” the place we consider that these capital allocation steps alongside continued progress in revenues and returns on capital, ought to start to make the market admire the super worth of this firm and, at what we contemplate a low, 8x EBIT, goal a number of and $30mm+ in extra money, ought to lead to a close to time period $40 value goal, or over 100.0% from in the present day’s value.

|

Authorized Disclosure The Partnership’s efficiency is predicated on operations throughout a interval of basic market progress and extraordinary market volatility throughout a part of the interval, and isn’t essentially indicative of outcomes the Partnership could obtain sooner or later. As well as, the outcomes are primarily based on the intervals as an entire, however outcomes for particular person months or quarters inside every interval have been extra favorable or much less favorable than the common, because the case could also be. The foregoing information have been ready by the Basic Companion and haven’t been compiled, reviewed or audited by an impartial accountant and non-year finish outcomes are topic to adjustment. The outcomes portrayed are for an investor since inception within the Partnership and the outcomes mirror the reinvestment of dividends and different earnings and the deduction of prices, the administration charges charged to the Partnership and a professional forma discount of the Basic Companion’s particular revenue allocation, if relevant. The Basic Companion believes that the comparability of Partnership efficiency to any single market index is inappropriate. The Partnership’s portfolio could include choices and different spinoff securities, mounted earnings investments, could embrace quick gross sales of securities and margin buying and selling and isn’t as diversified because the indices, proven. The Normal & Poor’s 500 Index incorporates 500 industrial, transportation, utility and monetary firms and is mostly consultant of the massive capitalization US inventory market. The Russell 2000 Index is comprised of the smallest 2000 firms within the Russell 3000 Index and is mostly consultant of the small capitalization U.S. inventory market. The Russell Microcap Index is comprised of the smallest 1,000 securities within the Russell 2000 Index plus the following 1,000 securities (traded on nationwide exchanges). The Russell Microcap is mostly consultant of the microcap section of the U.S. inventory market. All the indices are unmanaged, market weighted and mirror the reinvestment of dividends. Because of the variations among the many Partnership’s portfolio and the efficiency of the fairness market indices proven above, nonetheless, the Basic Companion cautions potential traders that no such index is instantly akin to the funding technique of the Partnership. Whereas the Basic Companion believes that up to now the Partnership has been managed with an funding philosophy and methodology much like that described within the Partnership’s Providing Round and to that which might be used to handle the Partnership sooner or later, future investments might be made underneath totally different financial situations and in several securities. Additional, the efficiency mentioned herein doesn’t mirror the Basic Companion’s efficiency in all totally different financial cycles. It shouldn’t be assumed that traders will expertise returns sooner or later, if any, akin to these mentioned above. The data given above is historic and shouldn’t be taken as any indication of future efficiency. It shouldn’t be assumed that suggestions made sooner or later might be worthwhile, or will equal, the efficiency of the securities mentioned on this materials. Upon request, the Basic Companion will present to you an inventory of all of the suggestions made by it throughout the previous yr. This doc shouldn’t be meant as and doesn’t represent a suggestion to promote any securities to any particular person or a solicitation of any particular person of any supply to buy any securities. Such a suggestion or solicitation can solely be made by the confidential Providing Round of the Partnership. This info omits many of the info materials to a choice whether or not to spend money on the Partnership. No particular person ought to depend on any info on this doc, however ought to rely solely on the Providing Round in contemplating whether or not to spend money on the Partnership. |

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

from Finance – My Blog https://ift.tt/Zx1mRu5

via IFTTT

No comments:

Post a Comment