Joseph Sohm/Corbis Documentary by way of Getty Pictures

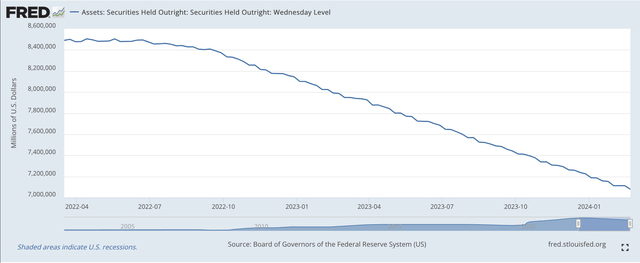

The Federal Reserve lowered its securities portfolio by $34.2 billion between January 31, 2024, and February 21, 2024, and this introduced the overall discount as much as $1,412.5 billion since March 16, 2022, the time the Fed started its present coverage stance of quantitative tightening. Observe: all information associated to the stability sheet of the Federal Reserve comes from the Fed’s H.4.1 statistical launch Components Affecting Reserve Balances of Depository Establishments.

Securities Held Outright (Federal Reserve)

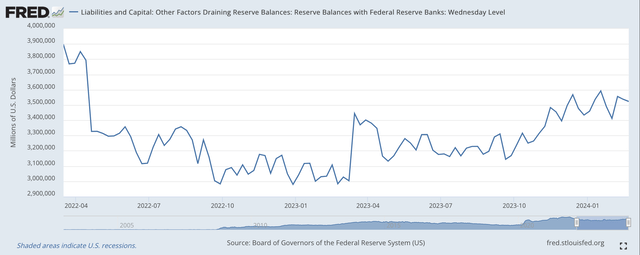

The quantity of extra reserves within the banking system (Reserve Balances With Federal Reserve Banks) fell in February by virtually $100.0 billion. Extra reserves have dropped by$370.3 billion because the begin of the quantitative tightening.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Observe that there are actually two durations represented on this chart. The primary interval runs from the center of March 2022 to March 2023. This was the time interval that the Fed was actually tightening up on financial institution liquidity, and reserve balances dropped from about $3.9 trillion to $3.0 trillion.

The second interval started in March 2023 as a number of giant industrial banks skilled monetary hassle, with a handful of them really failing.

Observe that the Federal Reserve has really allowed the surplus reserves within the banking system to extend. As of February 21, 2024, the quantity of extra reserves within the banking system has really elevated, rising to greater than $3.5 trillion.

The Federal Reserve is overseeing the discount of securities held outright in its portfolio however can also be participating in actions that won’t strap the industrial banking system too severely, permitting extra reserves in industrial banks to stay comparatively free.

That’s, the Fed is sustaining its program of lowering frequently the quantity of securities that the Fed holds outright in its securities portfolio however is managing the quantity of liquidity within the industrial banking system in order to maintain extra banks from failing.

However, there’s concern over the potential of financial institution failures. Sheila Bair, former Chair of the Federal Deposit Insurance coverage Company, and Charles Goodheart Emeritus Professor within the Monetary Markets Group on the London College of Economics write within the Washington Publish in regards to the future risk of extra financial institution failures right now.

They write, “Critical challenges stay for the U.S. banking system. A deteriorating industrial actual property market, rate of interest uncertainty, and the lingering danger of recession require financial institution executives to be laser-focused on robust danger administration.”

Moreover, analysts level to the large quantities of debt excellent, in bank cards, the federal authorities, and in lots of different locations. And, the debt load is giant internationally in addition to domestically.

However, for now, the economic system appears to be chugging alongside comparatively easily.

What appears to be carrying issues alongside is the large amount of money that also stays within the economic system.

Simply above I pointed to the surplus reserves within the industrial banking system totaling greater than $3.5 trillion.

And, everywhere in the economic system, there appear to be substantial pockets of liquidity that exist, and these sectors appear to be energetic customers of the cash.

So, what’s occurred to the demand for cash on this atmosphere?

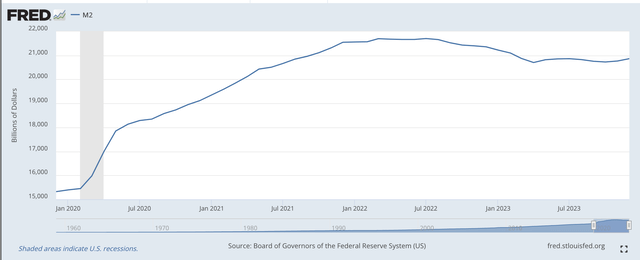

M2 Cash Inventory (Federal Reserve)

Right here we see the efficiency of the M2 cash inventory since January 2020. The expansion of the M2 cash inventory accelerates within the early a part of this chart because the Federal Reserve accelerates its response to the dislocations being created because of the unfold of the COVID-19 pandemic.

The accelerated development of the M2 cash inventory accompanies the fourth tough of the quantitative easing when extra reserves had been constructed up within the banking system to greater than $4.25 trillion.

The M2 cash inventory peaked round March 2022 because the Federal Reserve moved into it coverage of quantitative tightening and has been declining since.

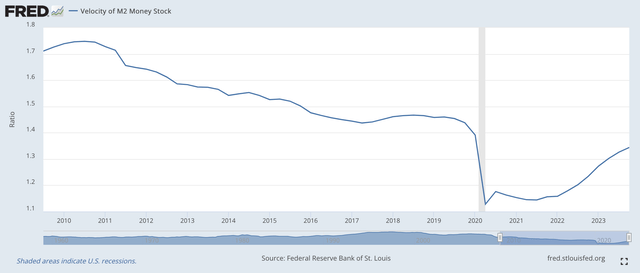

The fascinating factor right here is that the speed of the M2 cash inventory had been happening. That’s the M2 Cash Inventory was not “turning over” as quickly because it did at an earlier time.

Velocity of M2 Cash Inventory (Federal Reserve)

What appears to have been occurring throughout this time interval is that individuals had been really utilizing cash much less, and fewer, and fewer.

In different phrases, the Fed was pumping a lot of cash into the economic system right now, however financial models had been utilizing the cash much less and fewer and fewer. Due to the uncertainty of the instances, financial models had been holding onto their cash.

Folks constructed up their money holdings reasonably than go proper out and spend them. That is one purpose why inflation didn’t turn out to be worse throughout 2020, 2021, and 2023. Folks had been holding on to their cash. They weren’t dashing out and spending it

Now, the economic system is choosing up financial exercise, though the Federal Reserve has gone by virtually two years of quantitative tightening, The Fed has put the cash into the economic system, the economic system was simply not “utilizing” the cash to get the economic system going once more,

The economic system had the cash on its books. Business banks had been simply not utilizing the cash.

And, it appears as if there’s nonetheless loads of cash mendacity across the edges of the economic system in order that the Fed can proceed quantitative tightening but consider that it has been doing its job to maintain loads of liquidity within the banking system and within the economic system.

In reality, the economic system nonetheless has sufficient extra liquidity within the monetary system that the financial growth can proceed with none additional cash being tossed into the banking system, The Federal Reserve can simply carry on doing what it’s doing and tackle the brand new duty

So, it appears as if the Fed is doing issues it must so as to take away the extreme quantity of financial institution reserves that had been channeled into the banking system throughout the pandemic and financial recession. Quantitative tightening ought to proceed.

Nevertheless, the Federal Reserve wants to concentrate on the amount of cash that’s nonetheless “on the market” and that would trigger a renewal of inflation. The state of affairs is a sophisticated one and the Federal Reserve must be cautious it doesn’t set off inflation as soon as once more.

However, the Fed has executed a very good job as much as right here and, I believe, has the correct pondering to maneuver forward, maintain the economic system rising, and keep away from a brand new bout of inflation,

And, that is the correct state of affairs to maintain inventory costs rising.

from Finance – My Blog https://ift.tt/o1QVPeq

via IFTTT

No comments:

Post a Comment