Galeanu Mihai

Investment Thesis

Dye & Durham (OTCPK:DYNDF) is a case of how a company with an exceptional product may not be a good investment if the capital allocation ends up compromising the financial health of the company.

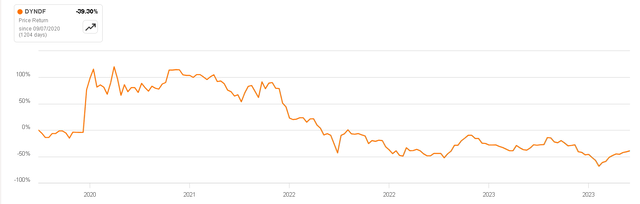

Since its IPO in 2020, the company has shown no return, exacerbated by an economic slowdown impacting its operations in Real Estate, Banking, and other economic transactions, along with a substantial increase in net debt, which is also at a variable rate. In this article, I want to delve into the highly attractive aspects of the business model, but also explore the points that concern me. This exploration aims to justify why, even though the valuation appears cheap, it could be outweighed by the risk/reward of investing in this company.

Price Return since IPO (Seeking Alpha)

Business Overview

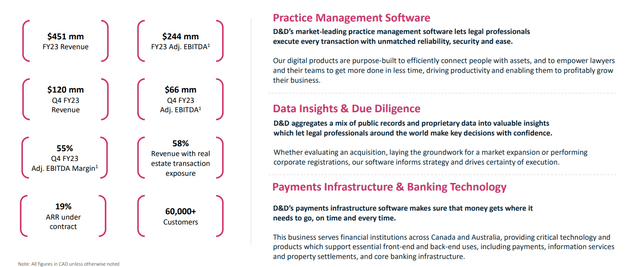

Dye & Durham is a Canadian company that provides cloud-based software solutions and services to legal and business professionals. The company focuses on streamlining and automating various bureaucratic and tedious processes in the legal and regulatory industries, such as the creation and management of legal documents related to real estate transactions, the preparation of electronic public records documents, automated searches of public records, among other operations essential in legal and business environments.

Dye & Durham Investor Presentation

Previously, the company charged a commission on each transaction for providing its software. For example, if a car lease or sale was processed for $50,000, the company charged between $8 and $16. Similarly, if there was a real estate transaction for $1 million USD, the company charged $129.

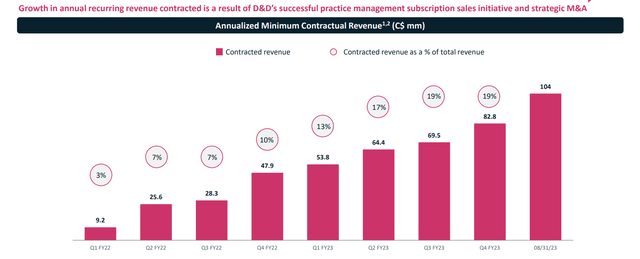

This means that for clients, it represents an insignificant sum compared to the benefit they obtained; however, it has a great disadvantage as it is a one-off income. Therefore, the company has decided to try to make its revenue more recurring through what they call ‘Contracted Revenue,’ which is the equivalent of a subscription for its clients to access the cloud solutions offered by Dye & Durham. Again, the price for accessing this can be quite insignificant compared to the benefits in time and cost savings.

Currently, approximately 19% of revenue could be considered recurring, and the target of the management is that within the next three years, at least 50% of revenue comes from this source.

Dye & Durham Investor Presentation

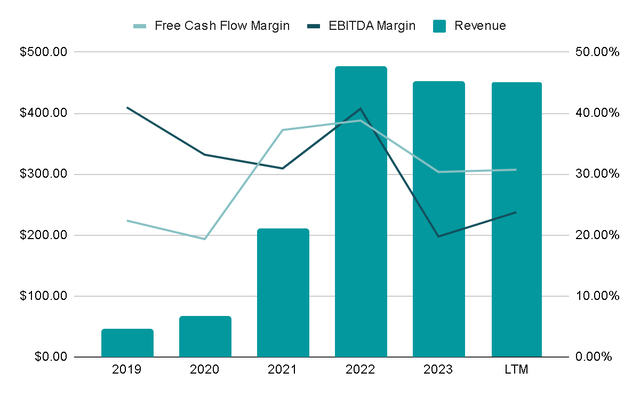

Although this transition would mean an improvement in predictability and margins, the company had previously performed well, achieving a compound annual growth of 57% in revenue with average EBITDA margins of 35% and Free Cash Flow of 30%. However, EBITDA margins are currently at around 24% due to the cooling of the real estate market and fears of a recession, along with rising interest rates that are delaying some transactions.

This further denotes the need to move towards a business model based on recurring income and not on transaction volume

It goes without saying, the year-over-year comparisons are less favorable reflecting lower transaction volumes driven by challenging macroeconomic conditions and uncertainty regarding inflation and rising interest rates.

Source: Q4 2023 Conference Call

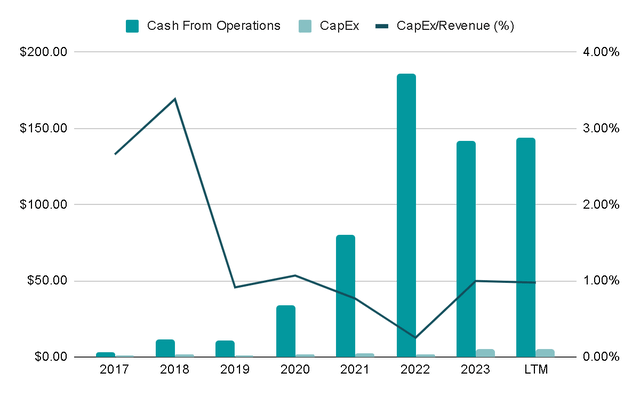

Author’s Representation

One reason why the company enjoys high margins is because, as a cloud software business, maintenance costs are minimal. This is reflected in the low percentage of revenue represented by capital expenditures, averaging only 0.8% over the last five years.

However, the company has invested significantly in growth, leading to depreciation and amortization that impact Net Income. Therefore, I believe it’s important to analyze this company using metrics such as EBITDA or Free Cash Flow, which exclude items that do not represent a real outflow of money.

Author’s Representation

For instance, during FY2023, the Net Income was -$170 million Canadian dollars, but the Depreciation and Amortization amounted to $150 million. Additionally, the company had to make an impairment charge of another $66 million, which does not represent a cash outflow and could be considered a one-time occurrence in this case.

Cash Flow Statement (Annual Report)

Capital Allocation

Although the business seems excellent so far, addressing a critical need for its clients, having potential recurring revenue, and enjoying high margins, there’s a significant concern casting a shadow on this promising picture: its capital allocation.

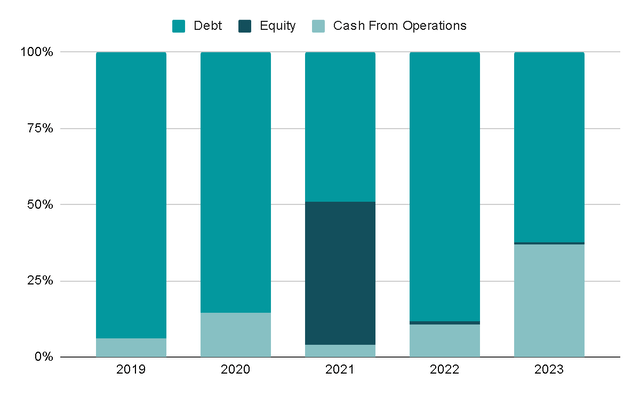

Over the last five years, they have issued $3 billion Canadian dollars in debt, while Cash From Operations generated has been only $450 million. Additionally, they issued $845 million in stock.

Author’s Representation

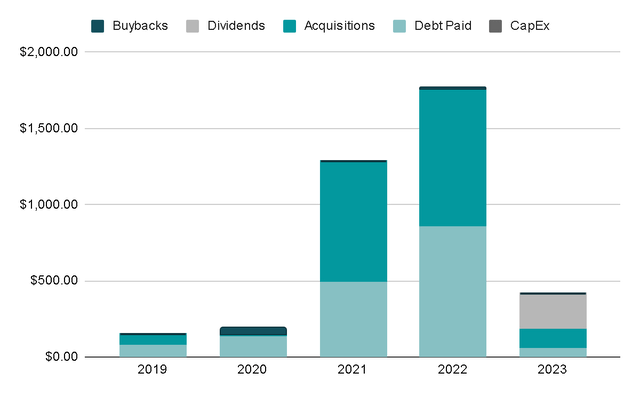

These funds were utilized for acquisitions. Over the last five years, $1.9 billion was allocated to cash acquisitions. While understandable given the fragmented market, in my opinion, this strategy has compromised the company’s financial position.

They also recently started paying dividends and doing some buybacks. It would seem better to me if they focused on buybacks considering how cheap the company is, but what I would like even more is for the enormous debt issued to be paid.

Author’s Representation

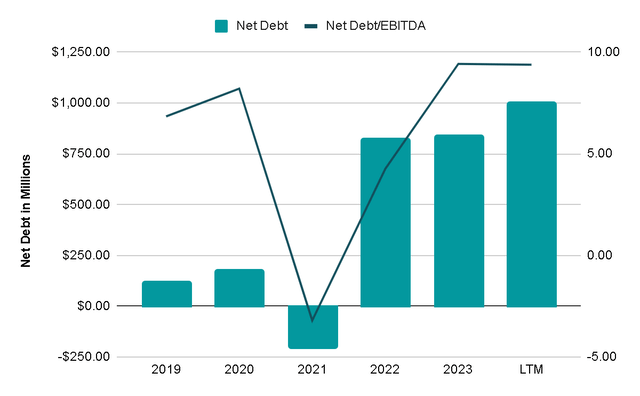

Currently, the company holds $1 billion in net debt (Total Debt of $1,026 million minus Cash & Equivalents of $20.45 million), representing 9 times the EBITDA generated in the last twelve months of $107.09 million. This level of debt is alarming. Since 2017, the company maintained an average Net Debt/EBITDA level of 6x, overleveraging itself to achieve rapid growth. In an environment with low interest rates, this strategy may have been viable, but the landscape has shifted. Consequently, the company is now exerting significant efforts to improve its debt position, having announced that 41% of its debt is at a fixed rate as of December this year, up from 24% previously.

Note – my EBITDA figure is lower than the figure shown in the presentation as I do not add back stock-based compensation, acquisition expenses, or other unusual items.

Maintaining 59% of debt at a variable rate, especially with a 9x Net Debt/EBITDA does not seem like the best idea to me, so it is essential that the changes to improve the financial position begin to reflect their effects as soon as possible.

Author’s Representation

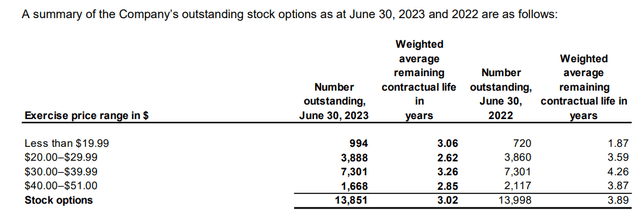

The explanation for how debt levels reached this point lies in the less-than-optimal incentives for the management team. When we scrutinize the stock options held by the management, currently, 93% of all possible shares they could acquire have exercise prices higher than $20 Canadian dollars. This is 33% above the current price in the Toronto market. Consequently, it wouldn’t make sense for the management to exercise stock options at $20 or $30 when they can purchase them in the open market for $15. This dynamic implies that their incentive is tied to maintaining a high share price, and one of the quickest ways to achieve this could be through acquisitions. For a company that still generates little cash flow, compared to the size of the acquisition targets they usually have, this approach ends up necessitating the issuance of debt.

Stock Options (Annual Report)

Final Thoughts

Although the stock is currently trading at 6x Free Cash Flow, and there are initial indications that interest rates may stabilize, I don’t think these debt levels are healthy at all, as they could cause the company to start allocating huge amounts of cash to pay debt and therefore sacrifice any possible dividends, buybacks or acquisitions. Instead, I believe the seemingly cheap valuation is entirely justified precisely for this reason.

Moreover, the debt levels are exceptionally high, with the majority at a variable rate, and the company is heavily reliant on a highly cyclical market, such as real estate. Considering these factors, it appears to be a potential value trap, so it seems prudent to stay away from this company, at least until leverage levels are successfully reduced. Therefore, I have decided to assign it a ‘Sell‘ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

from Finance – My Blog https://ift.tt/J3FcY7g

via IFTTT

No comments:

Post a Comment