yujie chen

U.S. Consumer Spending in 2023 has defied all economists’ expectations

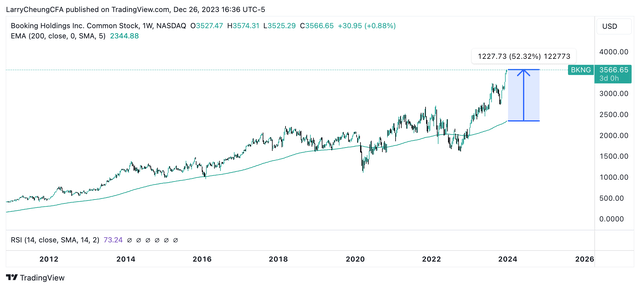

The U.S. consumer has endured the high interest environment in 2023, and has spent heavily towards travel & experiences – propelling online travel agency Booking Holdings (NASDAQ:BKNG) to over 52% above its 200 moving day average on longer term timeframes on the Weekly Candles.

This resilient consumer mindset is most likely attributed to a still-low U.S. unemployment rate beneath 4% while folks are enthusiastic that a recession has been averted given that the Fed is set to cut rates in 2024.

There is reason to be optimistic about a soft landing being achieved in the U.S., but the Fed has never been able to engineer a soft landing after such a historic interest rate hiking campaign. The lagged effects of the tight monetary policy has yet to be felt, and may ripple its effects through consumer psychology in 2024.

It is no coincidence that layoffs at Fortune 500 companies accelerated in late Fall of this year even though stocks rebounded. Examples of major layoffs include Spotify, Hasbro, Ernst & Young just to name a few. If the economy’s outlook has brightened in 2024, then why are layoffs happening even after investors look for a Dovish Pivot from the Fed? This is a conundrum that analysts are rushing to assess.

Booking.com has a fantastic position inside its industry and that has helped them preserve their operating margins (and stock price) to be elevated. 2024 will be the year where the global consumer faces its first big test from the Fed’s lagged monetary policy effects.

BKNG 50% above 200 Moving Day Average (TradingView)

The Catalysts for BKNG and Fundamental Outlook

Booking.com’s business has defied inflation and consumer debt concerns as the global consumer continues to view a soft landing as the most likely macroeconomic scenario. Their diversified geographic exposure across Europe, Asia, and North America has meant that their booking trends across Hotels, Restaurants, Flights, and Experiences have stayed enduringly strong over the past quarters. Specifically, its leadership position in Europe is likely to help BKNG fend off competitors as most of the hotels (about 60-65%) are boutique establishments that may be less willing to work with smaller online travel agency platforms to drive guest stays.

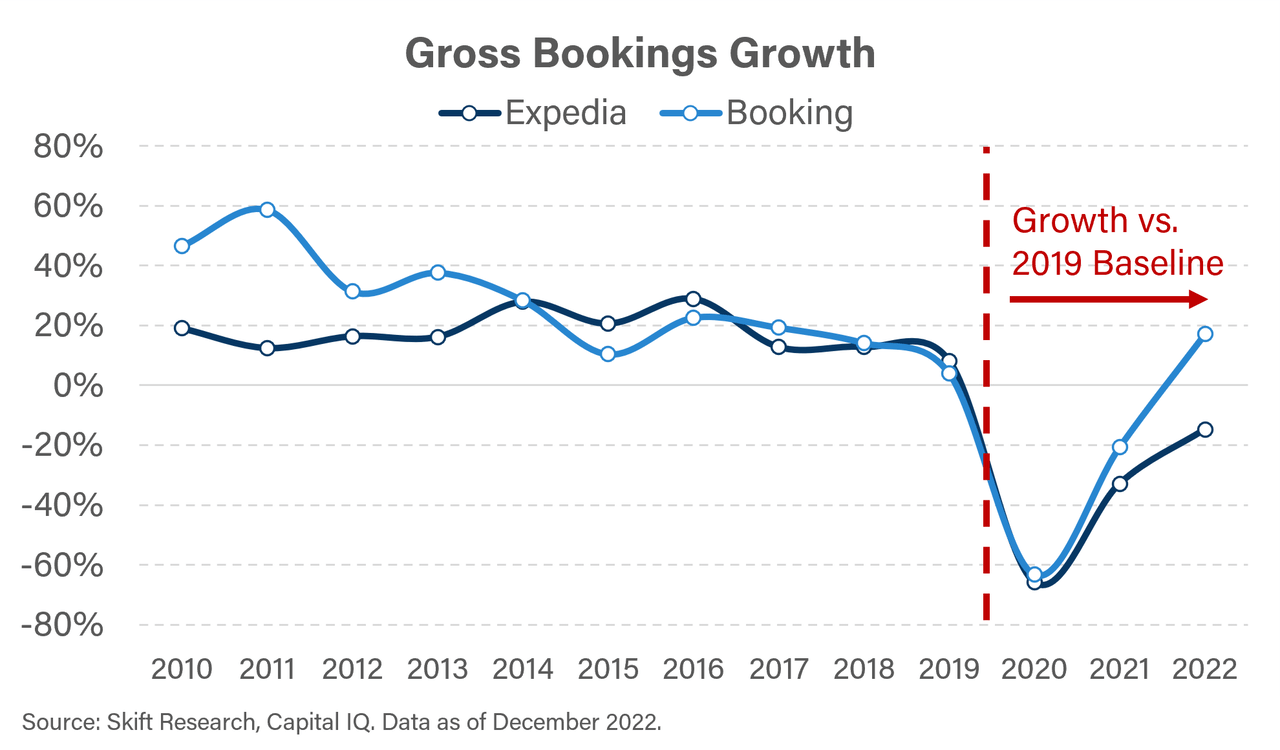

Its leading position is demonstrated through the fact that BKNG reserved 895 million booked nights compared to 312 million from Expedia and 394 million from Airbnb. Compared to its competition though, BKNG’s network effects have helped it to grow gross bookings the fastest post-pandemic.

Gross Bookings (Skift Research)

BKNG also has strong partnerships with Trip.com (TCOM) and Meituan which has helped it to leverage its strong network in China, which is an important market for the online travel agency industry over the coming decade. It’s estimated that APAC contributed 34% of the industry’s global growth since 2020.

Global Online Travel Agency Stats (Technavio)

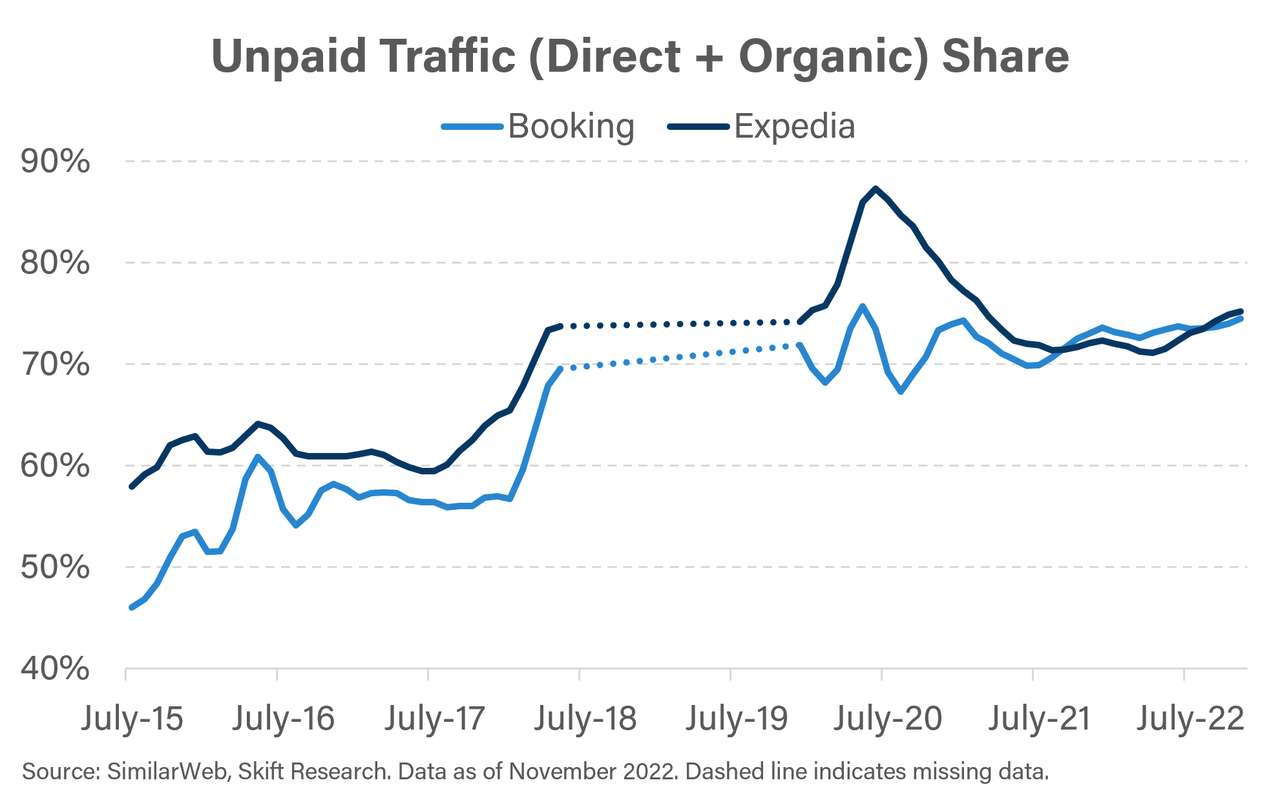

As of now, Booking.com is a top 10 rated App on the Apple Store in 131 markets compared to its smaller competitors Expedia and Airbnb. The company has several catalysts working in its favor as its strategy with Mobile app bookings is now a core driver of room nights being booked. Its strong brand presence, SEO optimized placements, and deep network of hotels & flights has resulted in more than 50% of room nights booked from direct traffic alone. Direct traffic accounting for such a large percentage translates into lower customer acquisition cost and lower aggregate paid marketing that eat into operating margins and profitability.

Organic Traffic (Skift Research)

However, given that Google is the primary place where customers find Booking.com’s offers, GOOG’s strategy to monetize paid sponsored placements at the top of Search being prioritized over organic search links may force BKNG to allocate more marketing expenses towards Google Ads.

Additionally, now that Booking.com gets about 50% of its bookings from Europe, it needs to further penetrate into other markets such as Asia-Pacific and the U.S. which may undergo a slowdown in consumer spending in 2024.

For now, BKNG is still the global market leader where their scale has helped them outspend the competition to remain top of mind among consumers. According to Euromonitor, Booking.com generated $121 billion in total bookings in 2022 which is estimated to represent 6% of the total travel market and 10% of the online travel market. This is in comparison to its peer Expedia which has an estimated market share of 5% for total travel and 8% for the online travel market.

Risks, Thoughts on Entry and Valuation

Booking.com does operate in a competitive industry where customers and users are most likely going to treat Airfare and Hotel prices like commodities – the provider with the lowest price wins given that the expected benefits are perceived to be exactly the same.

For this reason, a particular focus on the network effects is very important. The larger the number of listings on the platform, the more choices that consumers have to choose from and the more likely that they make the purchase from that platform. For reference, Booking.com has about 7 million listings for travel related listings while Expedia has 3 million hotel & lodging properties. Additionally, Expedia doesn’t compete as much in Europe and Asian markets where Booking.com has a stronghold presence.

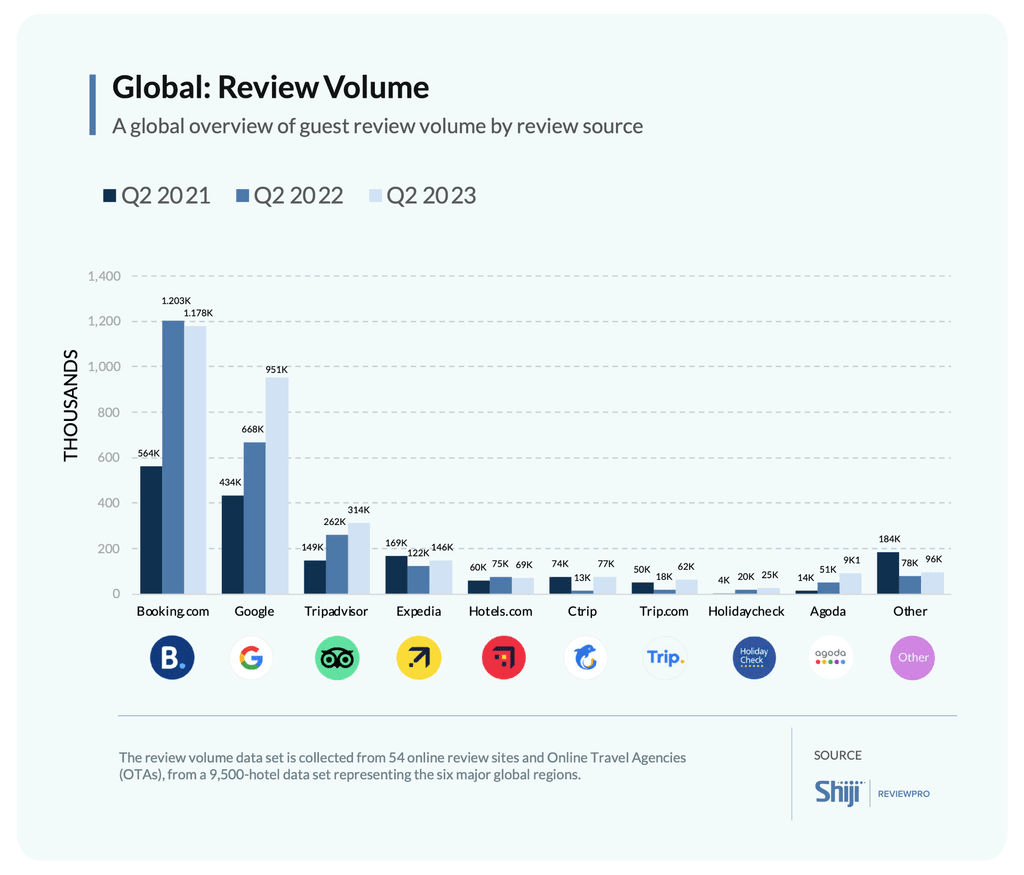

In the future, Booking could see greater competition from Big Tech companies that have already built sizable user networks and decide to enter the OTA (Online Travel Agency) space. Such companies that are in focus include Google, Meta, Amazon and China’s Alibaba. Google already holds a strong presence in the online travel ecosystem, and their advance represents a new emerging player in travel.

We can below that Google Travel is gaining strong momentum over longer timeframes.

Google Travel Volume (Shiji )

The entire travel booking market is estimated to be about $1.9 trillion, so new big competitors to Booking.com may be able to be absorbed.

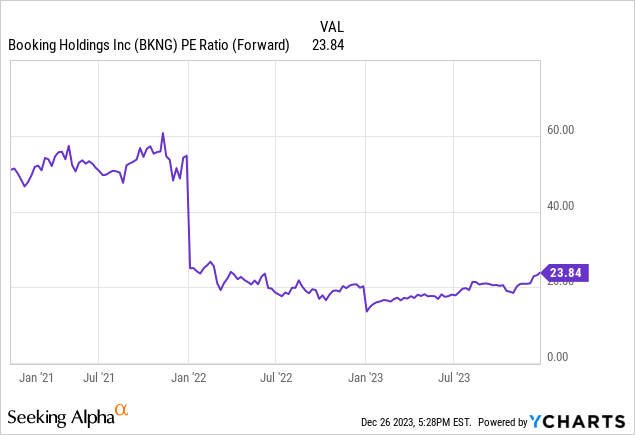

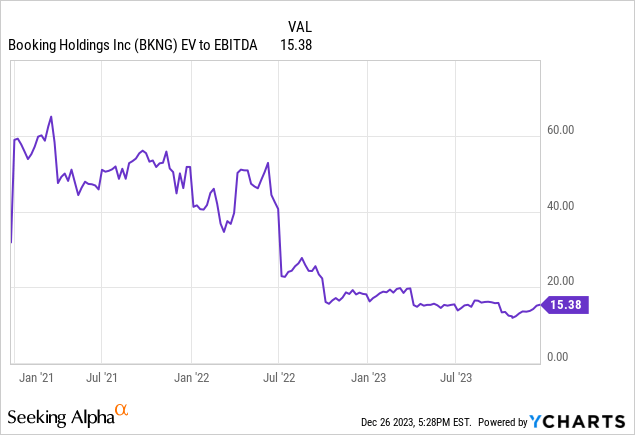

The company’s valuation is still friendly relative to its corporate history on Earnings and EV/EBITDA multiples on multi-year timeframes.

Booking.com’s strong price momentum is likely to persist until there is clear evidence that the consumer slowdown is here. Pullbacks are to be expected given the overbought nature of its stock, but its strong fundamentals means that large corrective phases are likely to be bought faster and in a more enduring manner than smaller competitors like Airbnb that have a more concentrated and narrow product focus.

from Finance – My Blog https://ift.tt/eYi8uNh

via IFTTT

No comments:

Post a Comment