Yau Ming Low/iStock Editorial via Getty Images

Investment Thesis

Western Union (NYSE:WU) was once one of the most important companies in the United States, but it is currently doing very poorly from the perspective of revenue and earnings growth. It’s reassuring to see that the company maintains good operational margins, and some investors will surely appreciate the strong dividend yield resulting from a low valuation relative to history. I’m quite frustrated that management seem to have no credible plan for growth, but I accept that many investors will prefer to focus on the company’s attractive valuation, relatively stable competitive position and strong record on dividends.

Background

Western Union is for most people a very familiar brand name, even for those who have not required its help in sending money across international borders. This is perhaps because it’s a company with a very long history, and was at one point so important for the United States that it was one of the 11 original companies in the first version of the Dow Jones Index. In 1861, the business was responsible for constructing the first transcontinental telegraph line, and over the years developed into a company which handled transfers of money via telegraph. Over recent decades, the progress made by the company has not been quite so impressive, and based on revenue and net income over recent years, it’s obvious that for this stock, and the company it represents, the prevailing story is arguably of a slow decline and negative growth.

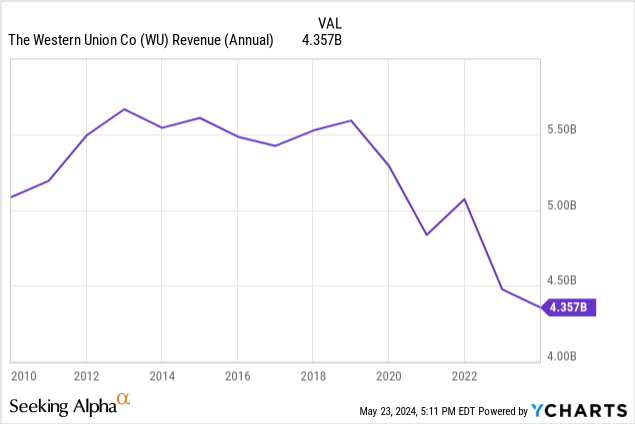

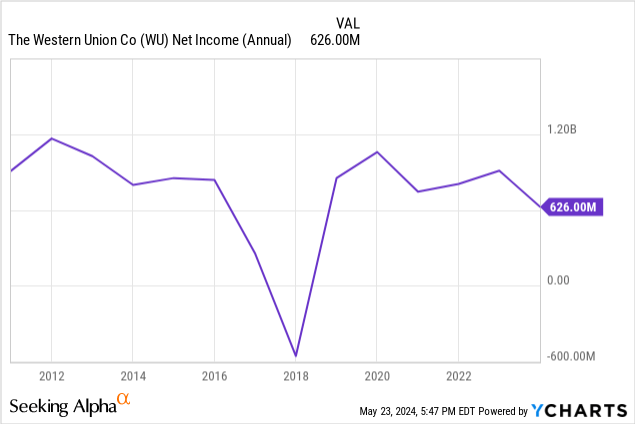

The chart above showing annual revenue dating back to 2010 shows the extent of the problem faced by the company in terms of stagnation.

Negative growth in net income over those same 14 years reflects the fact that management haven’t managed to make any significant efficiency savings or improve margins in some other way, either. Overall, with inflation taken into account, Western Union is a much smaller enterprise than it was even a decade ago. Many investors will rightly ask whether there is a plan from the company to reverse the direction of travel.

Poor Communication From Management

First Quarter 2024 Financial Results Presentation (Western Union Investor Relations)

Other analysts have spoken of the company’s potential to evolve into a company with a much greater focus on the digital component of the money transfer market.

I am very skeptical of this perspective, and of the management team more broadly, headed up by CEO Devin McGranahan, who has been in post since the end of 2021. This is because I have found very little evidence to support this thesis.

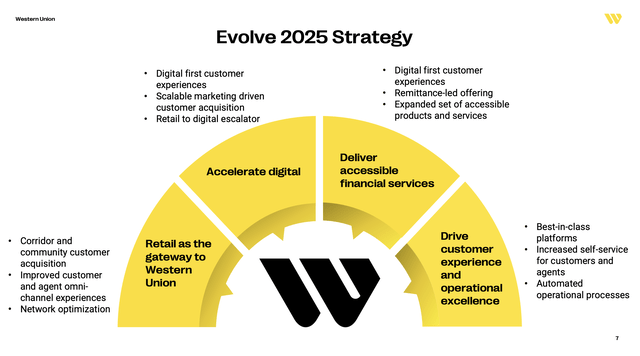

If you look at the slide above from a Q1 2024 Earnings Presentation, you can see a lot of word spaghetti, using pretty broad and meaningless phrases like “accelerate digital”, “network optimization”, “best-in-class platforms”, “operational excellence” and very little real substance on how the business will be improved over the next few years. Investors in my view need to look past this marketing nonsense and recognise that there is not really a sincere plan being acted on with the goal of making the company more efficient or more effective. The fact is that after scrutinising lots of quarterly reports and presentations etc., there is very little substance.

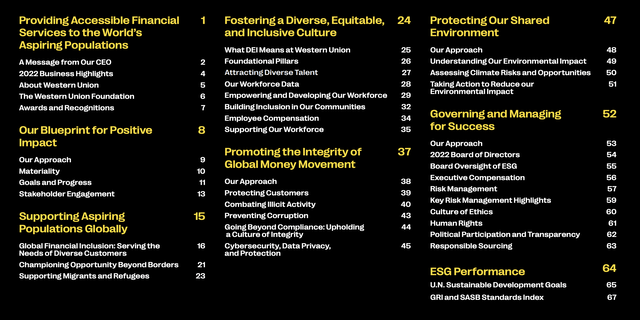

Environmental, Social and Governance Report (Western Union Investor Relations)

Contrasting the wishy-washy character of the previous slide on “Evolve 2025” with this very detailed table of contents for Western Union’s detailed plans for ESG initiatives, and I was given a sense of a company with little serious emphasis on growth, and lots of time being wasted in areas which are not moving the needle for investor returns.

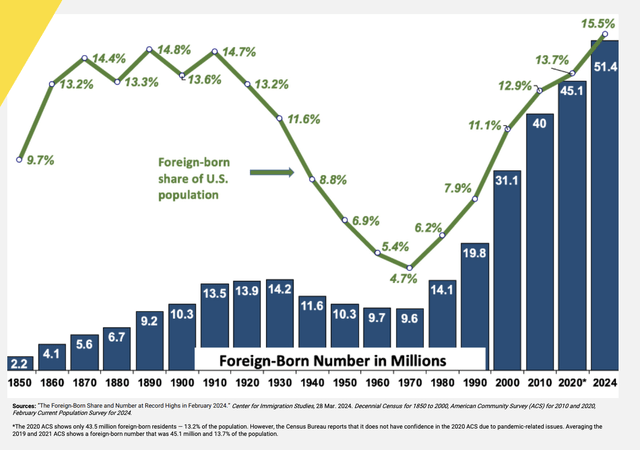

Impact Of Migration

I have seen a lot written about the impact of migration and especially illegal migration into the United States as a potential tailwind for Western Union in terms of generating greater revenues from this new base of potential customers who will want to remit funds to their relatives in their countries of origin.

First Quarter 2024 Financial Results Presentation (Western Union Investor Relations)

Western Union itself also seems to be encouraging this perspective, based on the inclusion of the above graph into their investor presentation.

I would personally argue that any impact of increased migration on revenues should already be apparent for the company, yet based on a 1% increase in first quarter revenues versus last year, this is not a factor which is making any real difference to Western Union’s performance.

Valuation

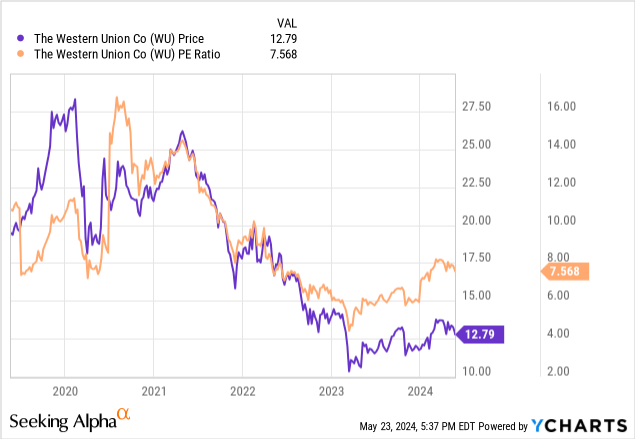

While still keeping my criticisms of the company in mind, I do accept that Western Union is trading at a very attractive earnings multiple relative to its history.

The graph above makes very clear that at a current price-to-earnings ratio of 7.5x, versus more than 16x at some points during the past five years, and a stock price of just under $13 compared with a price approaching $28 in 2020, Western Union is a cheap stock from the perspective of its earning potential, which has maintained relatively stable over the years, as previously highlighted.

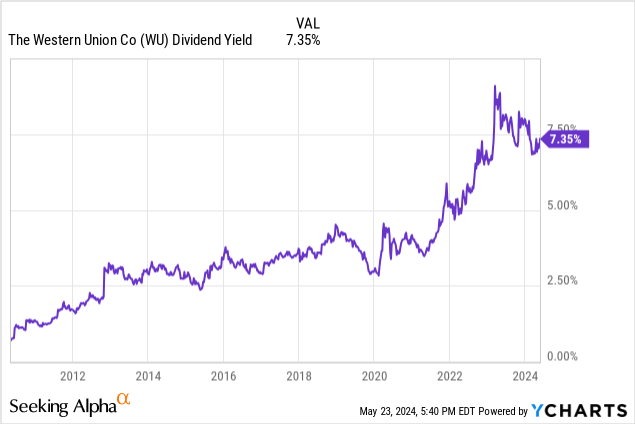

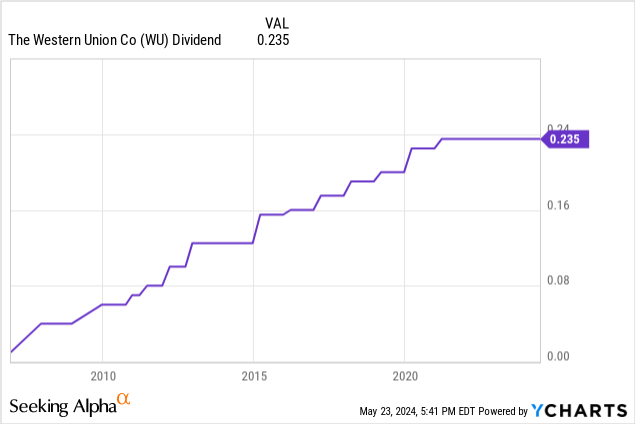

Dividend

One critical factor which I’m sure will attract many retail investors to this stock is the dividend yield in excess of 7%.

One thing which the management team of Western Union do need to be congratulated on, at least from the perspective of income investors, is their commitment to returning earnings to shareholders both through buybacks and dividends, and their policy of increasing and maintaining dividends to the maximum degree possible.

Conclusion

Western Union is, as I have mentioned, a company with a very widely recognised brand. It is not a company with a serious plan for growth as far as I am concerned, however, though that does not necessarily mean that it represents a poor investment, particularly for income-focused investors. It is a stock which is undoubtedly cheap relative to history based on earnings which are relatively stable, backed by a reasonably strong competitive position, even for a company which is undoubtedly in decline from the perspective of revenue.

I think that Western Union can be a reasonable addition to an income portfolio given the fantastic yield for those investors who feel that they have a reasonable understanding of the company’s operations and its ability to maintain its competitive position, but investors also need to be very conscious of the reality of zero or negative revenue and earnings growth which is likely over the coming decade.

from Finance – My Blog https://ift.tt/swtGWjh

via IFTTT

No comments:

Post a Comment