Massimo Giachetti/iStock Editorial via Getty Images

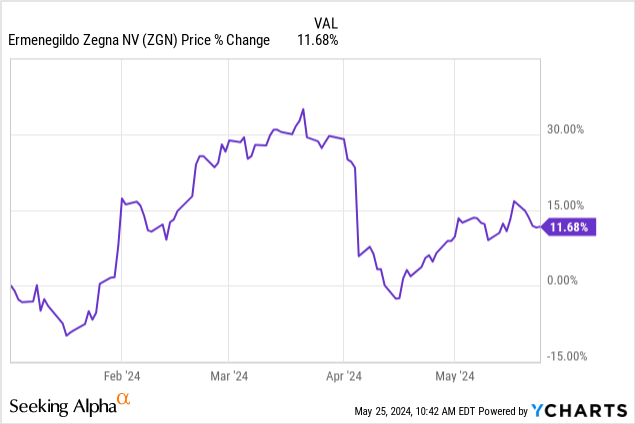

In January this year, I’ve presented the Zegna Group (NYSE:ZGN) as an interesting opportunity for investors due to the company’s sound financial results and the discounted valuation across the industry. Since the time of writing, the company published its comprehensive results for the last year and already a glimpse of 2024 through its Q1 revenue results. After I was almost ready to reap the fruits of my thesis when Zegna’s stock was up 30%, we’re now 12% ahead of this years’ start, after the company scared investors with a negative outlook for the first quarter given a setback at Thom Browne due to the management’s decision to streamline the wholesale business significantly. Additionally, we saw challenging demand in China across the brands, while the medium-term outlook for the company was once again confirmed.

As a consequence, I found it’s time to discuss the latest results to review my initial investment thesis and check whether Zegna is still a promising investment opportunity for investors – so let’s get right to it!

Operating Performance

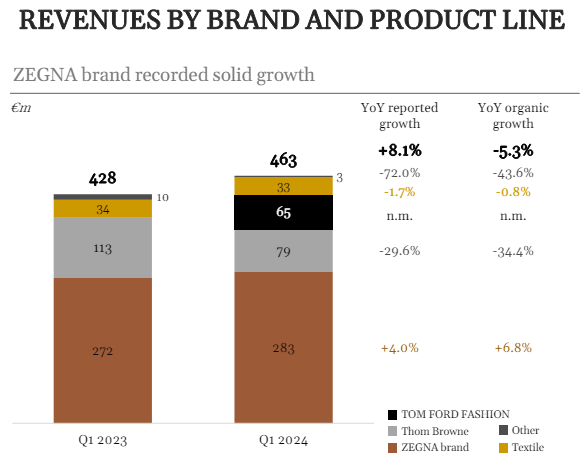

During the first quarter of 2024, Zegna achieved total sales of €463 million, which equals a growth rate of 8% compared to Q1/23. However, as projected by the management in early April, sales actually declined by 5% organically during the quarter, particularly due to a challenging environment in China and a significant cut of Thom Browne’s wholesale exposure. The difference between reported and organic numbers is mostly explained by the integration of Tom Ford Fashion that reported its first Q1 figures.

Q1/24 Sales by Brand and Product Line (Presentation)

ZEGNA

Having contributed an organic sales growth of 6.8% in Q1, the Zegna brand remains the most important growth engine for the company, while simultaneously representing the largest fraction of sales with 61%. While the brand received accelerating demand with double-digit organic growth in the U.S. and EMEA, China lacked behind, having reported a mid-single digit decline. In contrast to the organic growth rate of >35% in Q4/23, which was assigned particularly to the success of the ZEGNA One Brand strategy, these results are a bit surprising, although we have to admit that the comparables have caught up. In the latest call, Gildo Zegna commented on the situation in China as follows:

The Chinese market is currently experiencing a normalization phase for Covid, which is good news. For ZEGNA, the China market was allowed to launch the One Brand strategy. It is also where the entry-to-luxury offer was higher than other regions. We’re still working on brand awareness, client experience in store and merchandising. But even more, we are working on creating brand experiences.

And while the management plans to optimize OpEx in China, they were particularly clear about not cutting back on investments in brand awareness and customer experience. To this extent, ZEGNA will focus on invitation-only events and larger installations, like the “Oasi Zegna Lino” project in Shanghai. Meanwhile, the fully integrated supply chain could enhance the company’s ability to control and optimize inventory. Addressing both of these aspects, Gildo mentioned:

And I think that through this integrated supply chain, we can surely do a good job to control the level of inventory. And I think that is probably the area in which we are moving a lot of potential. As a matter of fact, we will have our headquarter team traveling to several cities in China to understand if the merchandising degree among cities has to be changed or what we can do to enhance the attraction of our brand, and in particular, to contribute to the new development of the new ZEGNA branding as we did in the space.

That being said, I’m continuously being optimistic about the brand’s prospects going forward, especially because the expansion of the new strategy is still new and in process.

Thom Browne

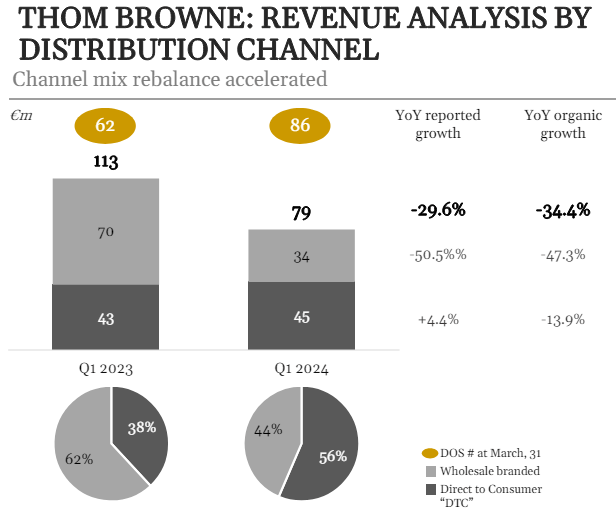

While Zegna can persist the current headwinds rather well, we’re facing a more significant decrease at Thom Browne this quarter. On an organic basis, the brand suffered with -34% YoY from the management’s decision to streamline its wholesale business.

Thom Browne: Q1/24 revenue by distribution channel (Presentation)

Accordingly, wholesale contributed only 44% of the brand’s total sales, in contrast to 62% in the previous year. Recalling last year’s CMD, this is actually very close to the medium-term target of 60/40 that already indicated a kind of restructuring. During the latest call, Gildo Zegna summarized the current situation as follows:

In recent months, we have made the difficult decision to reduce Thom Browne exposure to the wholesale channel. We took direct control of the brand’s operation in Korea, where the brand has a strong recognition and is performing ahead of the sector. In China, we have reinforced our regional management team. We’ve also worked on the collection themselves to protect the exclusivity of the highly recognizable products. All these will further enhance Thom Browne long-term value. While it will take some time to reap the rewards of this decision, our indicators already confirmed that the brand is strong and that our actions will make it even stronger.

Therefore, the company decided to limit Thom Browne’s exposure to online distribution in order to protect its exclusivity and desirability, which is reasonable in my opinion, especially if the management considered it necessary. Also, most of this cut was recognized in the Q1 results, while the next quarter will likely be in the low double-digits.

However, we find that also the DTC channel reflects the overall challenges that we’ve already encountered to a lesser extent at ZEGNA – reporting -14% YoY organically. The conversion of Korean stores into directly operated stores has more than offset this decrease and could even enhance the growth rate in the future. According to the management, the Group is able to increase the productivity of these newly converted stores by 50% and even hinted that they’re recognizing further opportunities for additional store openings.

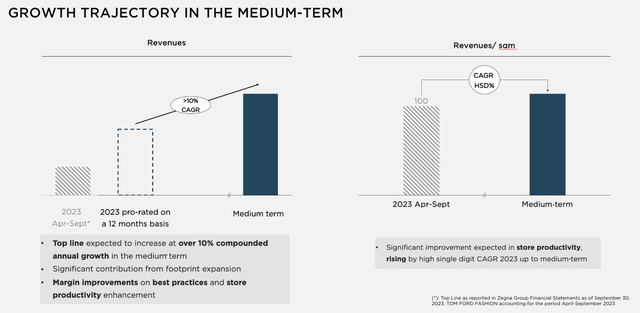

Tom Ford Fashion

In my last article, I discussed the potential of Tom Ford Fashion in 2024. Due to the brand’s positioning in the high-end luxury segment and the structural costs at the beginning, I noticed that investors should not expect this new segment to outpace the others right away. During Q1, Tom Ford Fashion contributed €65 million in revenue, which is slightly above the Q2 results from last year, which are our earliest individually reported numbers, but were overall a seasonal low. Therefore, the Q1 revenue will rather contribute 20% of the brand’s total sales in 2024, due to the new collection – which was only in stores for a few weeks – and additional store openings, e.g. a new flagship store in Rome and a new store in Beijing.

Medium-Term Outlook for Tom Ford Fashion (CMD 2023)

Due to these statements, I would expect the segment to perform closely to the medium-term guidance of a 10% CAGR, but especially more details on profitability will be interesting to see.

Overall Thoughts

The first quarter of 2024 certainly presented mixed results for investors. While the implementation and expansion of ZEGNA’s One Brand Strategy continued successfully, we faced particular weaknesses in China that were more visible in comparison with other high-end luxury brands. In addition to these current headwinds in the Chinese demand, the results were depressed by the management’s decision to reduce the wholesale exposure of Thom Browne significantly during the first three months of this year. Nevertheless, the medium-term guidance was reiterated, which further demonstrates that the company is currently setting up the brands to grow sustainably in the coming years.

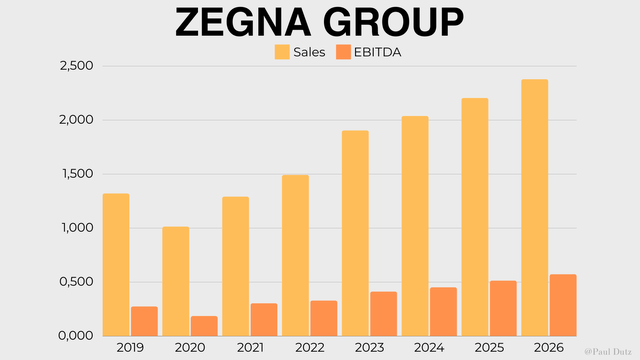

Sales and EBITDA, 2019-2026e, in € million (Own Illustration)

Nevertheless, the latest results also indicated that these brands are more fragile in their current state due to ongoing strategic transformations and organizational changes. As a consequence, I found my previously noted analyst’ estimates to be decreased, as they’re now anticipating the company to grow its revenue annually at around 7.7% until 2026. Meanwhile, EBITDA and EBIT are expected to grow at 11.6% and 13.8% per year, respectively, underlining the potential for further margin expansion and benefits of productivity enhancements. Despite these adjustments, I find myself confident in Zegna’s prospects to develop its brands successfully in the future, while we have to wait for more comprehensive data in the coming half-year results.

Valuation Update

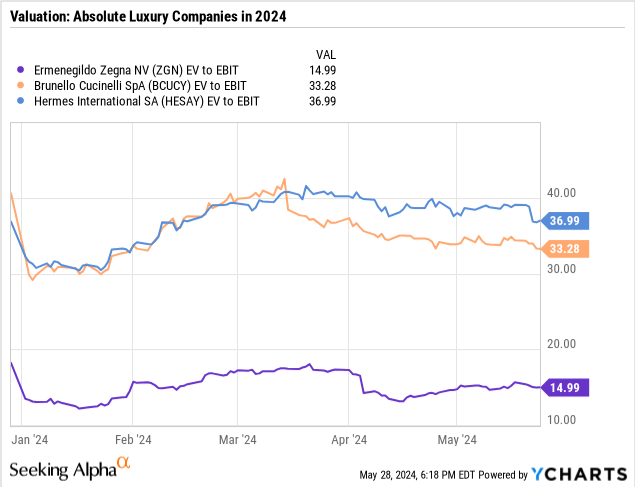

In addition to the appeal of the ZEGNA brand, the advantages of a fully integrated supply chain and the opportunities for Thom Browne and Tom Ford, one main argument of my investment thesis was the company’s valuation in contrast to the other luxury companies I follow. Since my last article was published, the share price of Zegna (ZGN) appreciated by about 12%, which is relatively close to the overall market performance. At a price of $12.43, at the time writing this article, Zegna is currently valued with a market capitalization of around $3,137 million or €2,890 million. Adding the newly obtained net debt of around €598 million (using the FY23 filings), we derive at an enterprise value of about €3,488 million.

Interestingly, the comparison to other often-cited peers in the segment of high-end luxury still present a remarkable divergence between Zegna and the rest due to a discount of more than 50%. Using the adjusted EBIT of the company, I derive at a current EV/EBIT multiple of 16x, which is almost the same result I derive when applying an updated assumption of the company’s free cash flow.

| in € million | |

| Operating Cash Flow | 275 |

| – Stock-based Compensation | 3 |

| – Changes in Net Working Capital | -133 |

| = Adjusted Operating Cash Flow | 405 |

| – Capex | 78 |

| – Payments on Lease Liabilities | 126 |

| = Free Cash Flow | 201 |

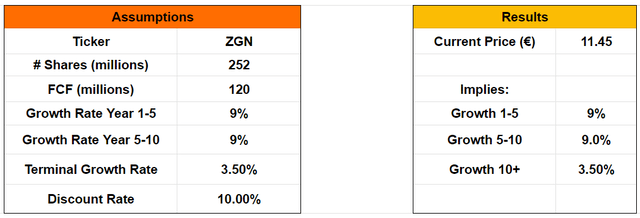

While I consider these adjustment useful to get a grasp of the company’s underlying cash flow generation, I would not actually expect the latest inventory build-up to be sold immediately this year, which would result in an actual free cash flow around €120 million I presume.

Inverse DCF model (Own Calculation)

As a result, the inverse DCF model yields a much more conservative growth rate than is currently implied by Zegna’s market valuation. With regard to the analyst expectations for the next three years of around 8% and the medium-term guidance of 10%, I obtained an expected growth rate of 9% per year for the next 10 years. From my perspective, this outcome is probably a good base-case scenario for the company, which is fair rather than optimistic given the short timeframe and low terminal growth rate. In addition, these assumptions didn’t take into account the targeted margin expansion in the coming years through increased pricing, improved organizational structures and efficiency.

Overall, I find that the current valuation offers a promising upside potential, especially if the company continues to successfully transform and position its key brands, thereby enabling a sustainable growth trajectory for a long period of time.

Conclusion

Having discussed the results of Zegna for the first three months of 2024 intensively, I remain confident in the long-term prospects of the company. That being said, I’m now also more aware that a significant amount of successful execution is necessary to achieve these targeted results in the medium-term despite current headwinds. Continuing to expand ZEGNA’s One Brand strategy, restructuring Thom Browne and integrate Tom Ford Fashion are among the key challenges that the company is currently addressing simultaneously. As a consequence, there is an execution risk that should not be underestimated by investors, although the family-owned luxury group has constantly expanded its management capabilities. From my perspective, investors find a promising investment opportunity in Zegna at the current price given that they agree on the assumptions made. Otherwise, I would probably wait until Zegna’s quality is reflected in higher margins and a more mature Zegna brand, and the level of uncertainty has shrunk.

from Finance – My Blog https://ift.tt/BZMzbwQ

via IFTTT

No comments:

Post a Comment