KeithBinns/E+ via Getty Images

Introduction

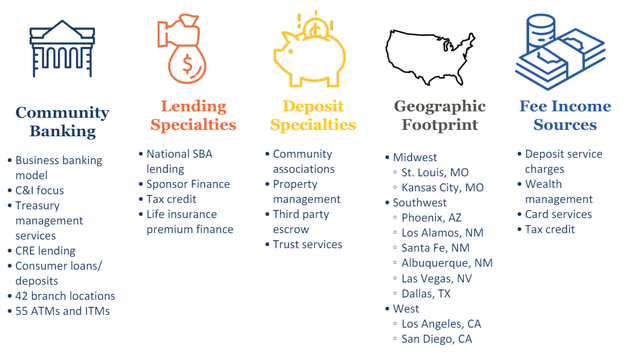

Enterprise Financial Services (NASDAQ:EFSC) is a Missouri-based holding company which owns the Enterprise Bank & Trust bank, which is active in Missouri and the Southwest, as shown below.

EFSC Investor Relations

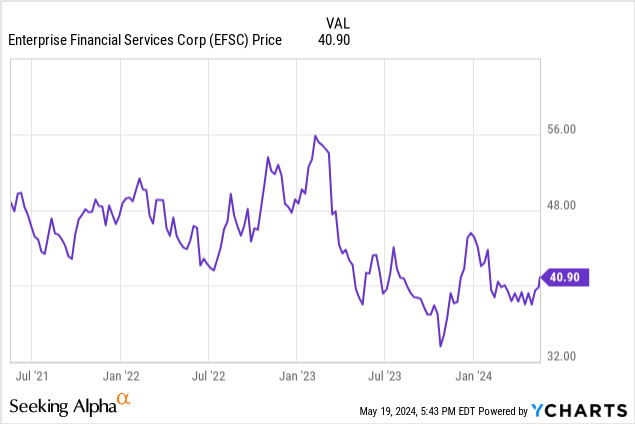

In a previous article, I had a closer look at the preferred issue of this financial institution and as the interest rates on the financial markets have increased, the share price of the preferred shares has come down, and that could potentially make them interesting again.

How is the bank dealing with the changing interest rate environment?

One of the key elements to keep an eye on these days are the net interest margins and the evolution of the net interest income of banks, as it is an important driver of the total net profit of a financial institution.

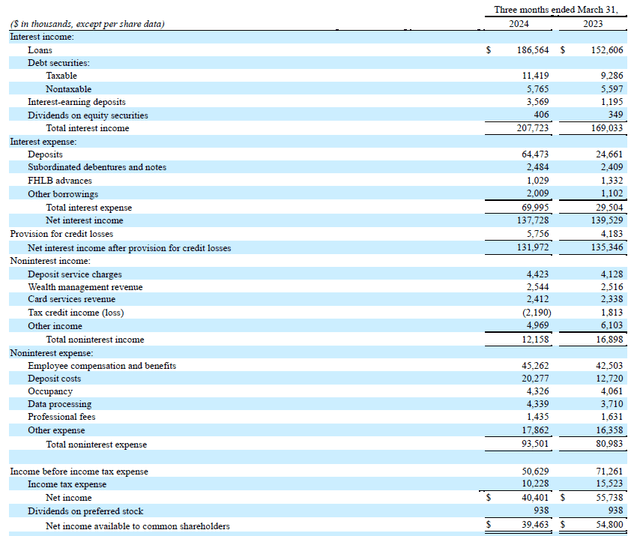

Looking at Enterprise Financial’s financial performance in the first quarter of this year, you can clearly see the bank’s interest income increase, but its interest expenses increased at a slightly faster pace, resulting in a minor contraction of the net interest income which decreased from $139.5M to $137.7M in the first quarter of this year compared to Q1 2023.

EFSC Investor Relations

Unfortunately, the bank also had to deal with a substantial increase in its net non-interest expenses. We see a sharp decrease in the non-interest income which fell by approximately $4.7M on the back of the reversal of a tax credit income, which turned into a loss in the first quarter of this year. Additionally, the total non-interest expenses increased by approximately $12.6M and although employee expenses went up, the main culprit is the so-called ‘deposit costs’ which jumped from $12.7M to $20.3M.

The net interest margin in the first quarter was 4.13% and according to the management’s statements on the Q1 conference call, we are close to the bottom. If there are no rate cuts, Enterprise Financial expects the net interest margin to bottom out at around 4% by the end of this year. However, rate cuts will likely further reduce the net interest margin, as Enterprise Financial expects to keep its deposit rates relatively high to remain competitive. It mentioned that with each quarter point reduction in the Fed Funds rate, there would be a 6 to 8 bp margin loss, representing approximately $2-2.5M per quarter. So while some banks are hoping for rate cuts, Enterprise Financial may actually be negatively impacted by rate cuts.

Going back to the income statement, the bank reported a pre-tax and pre loan loss provision income of just over $56M and after deducting the $5.75M in loan loss provisions and $10.2M in taxes, the net profit was $40.4M. Enterprise Financial needed just over 2% of that net profit to cover the preferred dividend payments of just under $1M per quarter, resulting in a net income of $39.5M attributable to the common shareholders of Enterprise Financial. That represented an EPS of $1.05.

A closer look at the loan book

While the net interest income is interesting and important, I am also always very interested in seeing details on the loan book.

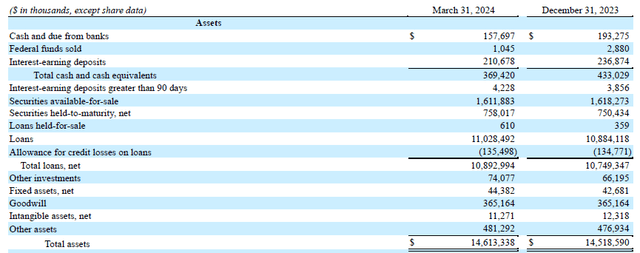

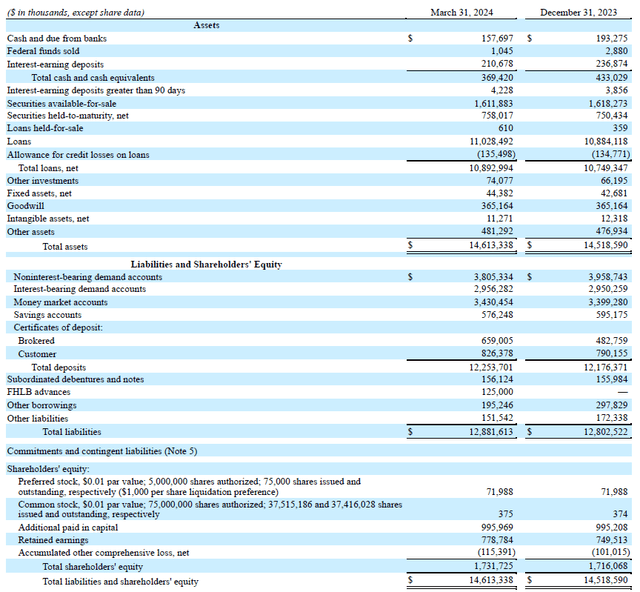

As you can see below, Enterprise Financial has a pretty liquid balance sheet with almost $370M in cash and deposits, and almost $2.4B in securities available for sale and securities held to maturity. This means that in excess of 22% of the $12.25B in deposits is held in cash or cash-like securities.

EFSC Investor Relations

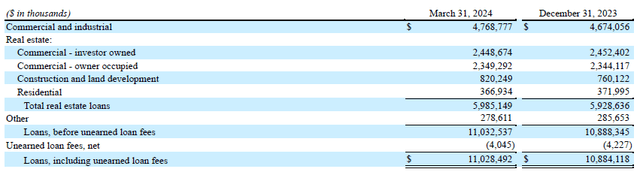

I’m more interested in the $10.9B in loans outstanding. As you can see below, the bank mainly is a business lender. It has issued almost $4.8B in commercial and industrial loans (SBA loans, and life insurance premium financing are key parts of its industrial and commercial loan portfolio) while the total amount of CRE loans is approximately $4.8B as well, with a 50/50 split between owner-occupied and investor owned commercial real estate.

EFSC Investor Relations

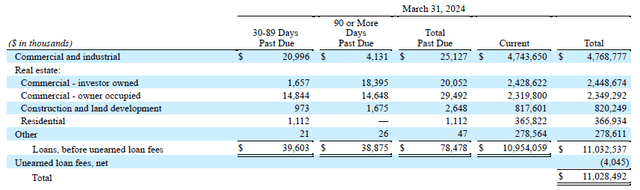

While the market doesn’t like banks with high exposure to CRE these days, it all depends on how ‘safe’ the loans are. Looking at the breakdown provided by Enterprise Financial, the total amount of loans past due is approximately $78.5M, of which approximately half is no longer accruing.

EFSC Investor Relations

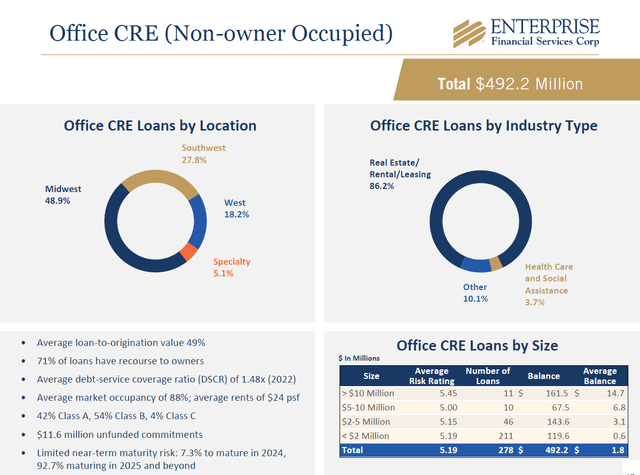

The total amount of loans past due has increased in the past quarter, but the amount of non-accruing loans decreased. And as of the end of Q1, the total allowance for credit losses of just over $135M is still more than sufficient to cover the non-accruing loans. Also, keep in mind that the majority of the non-accruing loans are backed by real estate and the bank will always have collateral to liquidate, which means the losses should remain relatively limited. Just as an example (shown below), in the office segment, which represents about 20% of the investor CRE loans, the average LTV ratio at the origination was just 49%, and in excess of 2/3 of the loans have recourse to the owners.

EFSC Investor Relations

Meanwhile, the bank’s balance sheet remains strong. The CET1 ratio increased to 11.4% at the end of the first quarter of the year, and the tangible book value per share was approximately $24.21. As the bank only pays a small dividend of $0.25 per share per quarter (to be increased to $0.26/share), the vast majority of its earnings are retained on the balance sheet. Useful, as the bank is still trying to grow and retaining earnings will help to support its loan book growth plans.

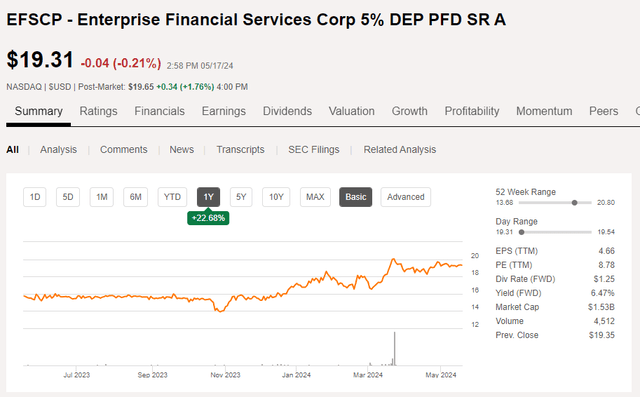

The preferred shares remain interesting

This regional bank has one series of preferred shares outstanding. As mentioned in my previous article, the non-cumulative preferred shares are trading with (NASDAQ:EFSCP) as ticker symbol and offer a 5% preferred dividend ($1.25 per year, payable in four equal quarterly tranches). The preferred shares can be called from December 2026 on and are currently trading at approximately $19.31. As the preferreds are trading at a discount to the principal value of $25/share, the preferred dividend yield is currently close to 6.50%.

Seeking Alpha

I have already established the preferred dividend coverage ratio remains excellent, and looking at the asset coverage ratio, I am not too worried either. As you can see below, the bank had about $1.73B in equity, of which about $72M was classified as preferred equity. The total principal value of the preferred equity is $75M, which means there’s approximately $1.65B in common equity that ranks junior to the preferred equity.

EFSC Investor Relations

As Enterprise Financial retains the majority of its earnings, the total amount of common equity on the balance sheet will likely continue to increase, making the preferred shares safer from that perspective.

Investment thesis

The bank’s loan book remains robust, as its total provisions for souring loans should be sufficient to cover the potential fallout from the non-accruing loans. Additionally, the current rhythm of adding just over $5M per quarter to the loan loss provisions will help to keep the total amount of provisions at an adequate level.

I am still interested in the preferred shares, and I think the current yield of around 6.5% offers a fair risk/reward ratio. I will keep an eye on the preferred shares as a potential candidate to add to the income-focused portion of my portfolio.

from Finance – My Blog https://ift.tt/UayLd2G

via IFTTT

No comments:

Post a Comment