LUMIKK555/iStock by way of Getty Photographs

RCI Hospitality Holdings (NASDAQ:RICK) operates nightclubs and sports-bar eating places. The corporate’s nightclub manufacturers embody Danger’s Cabaret, PT’s Showclub, Membership Onyx, and Tootsie’s Cabaret. RCI Hospitality’s restaurant model is the military-inspired Bombshells. The corporate has a protracted observe report of acquisitions and a few natural development initiatives, rising its footprint in the USA into 56 income contributing nightclubs and 14 Bombshells eating places as of Q1/FY2024 in line with the corporate’s Q1 investor presentation.

The inventory has carried out effectively on a long-term foundation with RCI Hospitality’s good execution of capital allocation. Previously decade, the inventory has compounded at a CAGR of 17.2%. The corporate does additionally pay out a dividend, however the yield may be very low at 0.42% as RCI Hospitality tries to search out extra opportunistic allocations for its money flows.

Ten 12 months Inventory Chart (In search of Alpha)

Opportunistic Capital Allocation

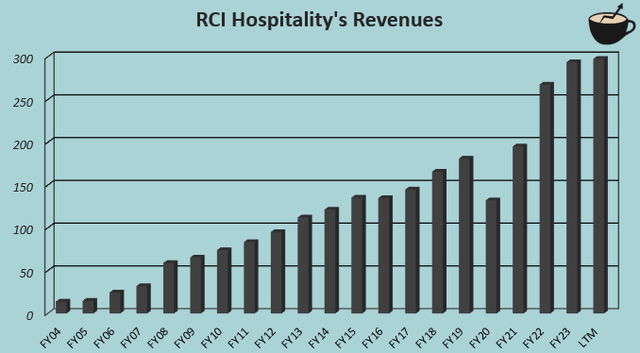

RCI Hospitality’s long-term technique of acquisitions has resulted in an excellent quantity of development – from FY2004 to present trailing revenues as of Q1/FY2024, the corporate has a income CAGR of 17.3%.

Creator’s Calculation Utilizing TIKR Information

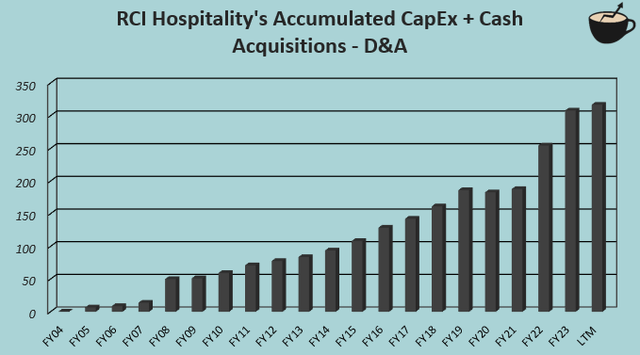

The expansion has been achieved by way of fixed development investments – from FY2004, to scale the corporate’s operations, RCI Hospitality has now spent over $300 million in capital expenditures and money acquisitions in complete excluding depreciation & amortization that ought to relate fairly effectively to upkeep capital expenditures. The corporate’s capital allocation has additionally allowed for lowering excellent shares by way of share buybacks, as weighted common excellent shares have decreased barely from 9.8 million in FY2014 right into a present 9.4 million.

I imagine that the capital allocation technique is nice, confirmed by the unbelievable inventory appreciation, and nice EPS development going from $1.15 in FY2014 right into a present trailing $2.80. The corporate continuously targets new nightclub acquisitions at 3-5x EBITDA, opportunistic share buybacks and natural new unit investments for development. RCI Hospitality targets to personal 200 places in the long run; the corporate continues to be comparatively small, and has a large amount of area for development sooner or later. In FY2023 alone, the corporate deployed $77.9 million into nightclubs, $17.3 million for Bombshells eating places, and $7.5 million for present on line casino investments.

Creator’s Calculation Utilizing TIKR Information

Secure and Excessive Profitability

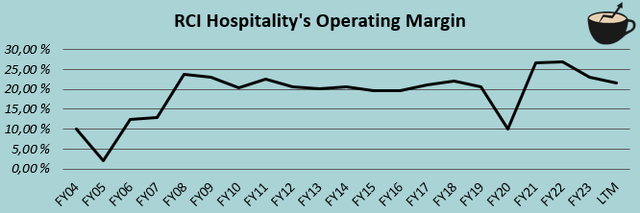

RCI Hospitality can be capable of preserve a very good profitability – the corporate has had fairly a steady working margin a bit above 20% in previous years, excluding some turbulence through the Covid pandemic. RCI Hospitality prefers to purchase the actual property for its owned places, contributing into the earnings enormously; whereas proudly owning the actual property makes the expansion technique costlier, it does present stability and a better degree to the corporate’s profitability.

Creator’s Calculation Utilizing TIKR Information

Enlargement into On line casino Providing

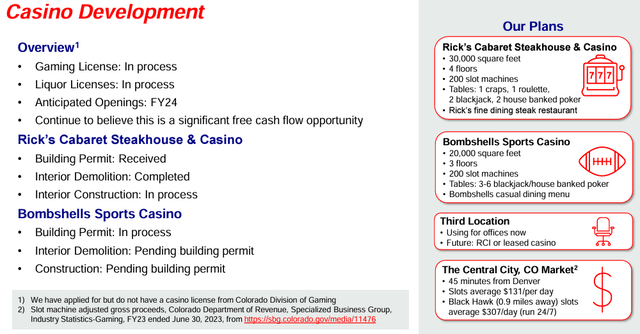

RCI Hospitality plans to increase into the on line casino section with a deliberate 30 thousand sq. ft Rick’s Cabaret Steakhouse & On line casino, in addition to a 20 thousand sq. ft Bombshells Sports activities On line casino. The corporate anticipates to open each in FY2024, with some pending permits nonetheless slowing down the progress.

RICK Q1 Investor Presentation

RCI Hospitality’s administration appeared assured within the casinos’ money movement technology within the Q1 earnings name. The companies have been talked about to have important money movement potential for the corporate, and the vertical appears to be a brand new addition to RCI Hospitality’s development avenues, with potential to increase the on line casino mannequin into different states being talked about within the earnings name on a extra long-term view.

Slim Brief-Time period Upside

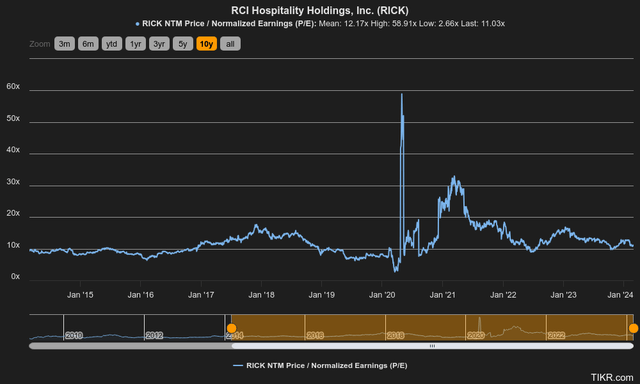

Previously decade, RCI Hospitality has traded at a median ahead P/E a number of of 12.2. Presently, the inventory trades barely under the historic determine at 11.0, as rates of interest are at present larger than within the prior decade on common.

Historic Ahead P/E (TIKR)

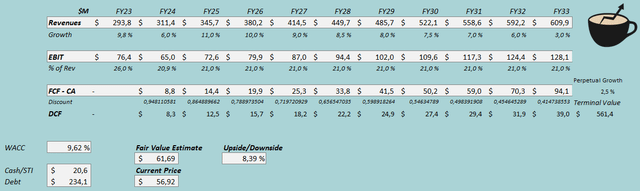

To estimate a tough honest worth for the inventory, I constructed a reduced money movement mannequin. Within the DCF mannequin, I consider acquisitions as they’re vital in RCI Hospitality’s technique; for FY2024, I estimate a development of 6% with a slower macroeconomic improvement affecting same-store gross sales negatively. Afterwards, I estimate a development of 11% in FY2025 that slows down right into a perpetual development of two.5% in steps, successfully translating to slowing down acquisitions that largely cease in FY2033 with a development of three%. The overall estimated income CAGR is 7.6% from FY2023 to FY2033. Within the firm’s Q1 earnings name, CEO Eric Langan associated to a goal of 10% development in free money movement over the subsequent two years.

I count on the corporate’s profitability to remain steady, and solely to extend by 0.1 proportion level from an estimate of 20.9% into 21.0% in FY2025 and ahead. With the slowing estimated development, I estimate RCI Hospitality’s money movement conversion to enhance from a poor conversion estimate in FY2024 into fairly a very good one in FY2033 as acquisitions cease within the mannequin.

With the talked about estimates together with a value of capital of 9.62%, the DCF mannequin estimates RCI Hospitality’s honest worth at $61.69, round 8% above the inventory worth on the time of writing. Whereas the corporate has nice capital allocation, I don’t see important short-term upside for the inventory. Nonetheless, the inventory appears to have some slight undervaluation, and the long-term appreciation potential must be fairly good. The corporate might additionally proceed the acquisition technique considerably longer than the ten-year interval which I estimate within the DCF mannequin, proving a greater honest worth than my mannequin estimates.

DCF Mannequin (Creator’s Calculation)

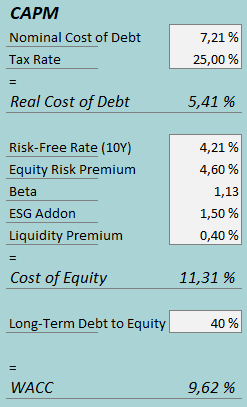

The used weighted common value of capital is derived from a capital asset pricing mannequin:

CAPM (Creator’s Calculation)

In Q1/FY2024, RCI Hospitality had $4.2 million in curiosity bills. With the corporate’s present quantity of interest-bearing debt, RCI Hospitality’s annualized rate of interest comes as much as 7.21%. The corporate itself communicates a weighted common rate of interest of 6.61%, however I imagine that the precise curiosity together with lease curiosity is a fairer estimate to make use of. The corporate makes use of fairly a very good quantity of debt, and I estimate the long-term debt-to-equity ratio to be round 40%.

For the risk-free price on the price of fairness aspect, I exploit the USA’ 10-year bond yield of 4.21%. The fairness danger premium of 4.60% is Professor Aswath Damodaran’s newest estimate for the USA, up to date on the 5th of January. Yahoo Finance estimates RCI Hospitality’s beta at a determine of 1.66. I imagine the enterprise to be extra macro resistant than the determine lets imagine; as an alternative, I exploit Zacks’ estimate of 1.13, which the inventory had on the finish of 2019 previous to the pandemic that appears to have induced an uptick in beta in recent times. Lastly, I add an ESG add-on of 1.5% and a small liquidity premium of 0.4%, creating a value of fairness of 11.31% and a WACC of 9.62%.

As an fascinating word, RCI Hospitality’s capital allocation technique contains opportunistic share buybacks in case the shares’ free money movement yield exceeds 10%. My CAPM estimates the corporate’s value of fairness at 11.31%; when factoring in modest natural free money movement development, the share buyback rule of thumb seems like an inexpensive technique.

Takeaway

RCI Hospitality has an ideal technique of making shareholder worth by way of acquisitions. The corporate drives worth by way of low-cost acquisition valuations, opportunistic share buybacks, and natural investments such because the newly developed casinos. The technique contains proudly owning the actual property through which RCI Hospitality operates, making the expansion extra capital intensive however offering earnings stability. Whereas the technique is nice, I don’t see very important short-term upside within the inventory’s worth – in the interim, I’ve a maintain score on the inventory.

from Finance – My Blog https://ift.tt/YwpI2SH

via IFTTT

No comments:

Post a Comment